Good morning!

I note that Revel Collective (LON:TRC), formerly known as Revolution Bars, now intends to appoint administrators. Existing shareholders were already set to be wiped out, and so the only question remaining is whether or not it can be sold as a going concern. Hopefully it can - "discussions are well advanced, and the Board anticipates a further announcement in the coming days."

It would be easy to view this as indicative of wider economic weakness, but my sense is that TRC would have been fragile regardless of the state of the economy.

Out of time for today, thanks everyone.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

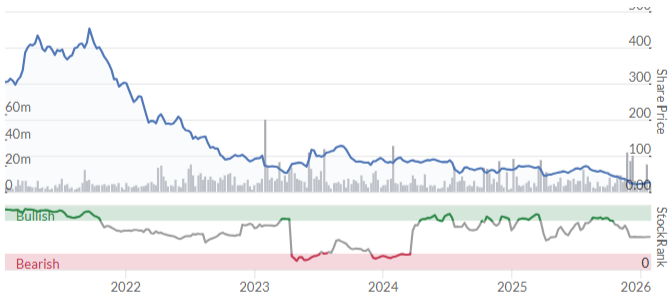

Sage (LON:SGE) (£10.0bn | SR38) | Q1 organic revenue +10%, with Sage Business Cloud +15%. FY26 guidance unchanged. - North America +12% to £304m (FY25: +11%). - UK & I, APAC, Africa (UKIA): +10% to £194m (FY25 +9%): - Europe +7% to £176m (FY25: +6%) | AMBER/GREEN ↓ (Roland - I hold) [no section below] Today’s short update seems reassuring to me. Q1 organic revenue growth of 10% is consistent with the company’s FY26 guidance for “organic revenue growth of 9% or above”. The other half of that guidance is for profit margins to improve from 2026 onwards as economies of scale feed through. There’s no comment on margins today but CFO Jacqui Cartin does “reiterate our full-year guidance”. Sage stock has fallen by 21% over the last year and the StockRanks are cautious. However, forecasts suggest EPS growth of c.14% in FY26 and FY27 and quality metrics remain strong, with ROCE of 22.5% last year. I see this as a long-term quality compounder and remain happy to hold. As others have commented, I think risks around AI are overblown. AI will inevitably become part of the company’s standard product set, but I don’t think generalised AI will replace accounting software. For me, the main risks are a) exposure to an economic slowdown in the US/Europe and b) failing to maintain or extend its market share versus larger US rival Intuit. I think the stock is now coming back down to a level where it could be attractive for me to add to my existing long-term holding. However, I’m going to temper this positivity with a note of caution on the economic sensitivity and competitive pressures faced by this business. | |

Cranswick (LON:CWK) (£2.8bn | SR72) | Strong trading in quarter with record Christmas trading. Now expect FY26 adj pre-tax profit to be at upper end of market expectations (£211.3m to £216.0m). Shore Capital upgraded forecasts: | AMBER/GREEN = (Roland) [no section below] Today’s update from this meat production group reads well and highlights continuing growth and expansion into adjacent markets. Although the 1% upgrade to broker Shore’s earnings forecasts is minimal, it extends a long-running positive trend. FY26 consensus EPS forecasts have risen by c.10% over the last 18 months. Cranswick shares aren’t cheap and the company is still working through a broad set of recommended improvements following last year’s investigation into the alleged mistreatment of pigs at one of its farms. While I paraphrase, my impression from the resulting independent report is that there was no smoking gun, but there was room for improvement in a number of areas. The company is now addressing these. On balance, I think this remains a good quality business with useful scale and a strong track record. I am happy to leave my previous broadly positive view unchanged. | |

MITIE (LON:MTO) (£2.26bn | SR83) | Revenue +10% (+4% organic) with £4.7bn of contract wins/renewals (FY25: £4.8bn). On track for FY26 revenue of c.£5.7bn, op profit of >£260m and free cash flow of >£120m. | ||

Paragon Banking (LON:PAG) (£1.73bn | SR54) | Total lending +6.9% to £724m with buy-to-let +0.4% and commercial +17.6%. FY guidance unchanged. | ||

Energean (LON:ENOG) (£1.67bn | SR43) | FY25 production of 154 kboepd, at upper end of guidance (145-155 kboped). Revenue and adj EBITDAX in line with prior year despite lower energy prices. FY26 prod guidance 140-150 kboped. | ||

WAG Payment Solutions (LON:EWG) (£859m | SR76) | Revenue +13%, “adj cash EBITDA” to be above previous guidance of c.€95m. FY26 focus on migrating customers to Eurowag Office platform, FY26 guidance for low double-digit revenue growth and stable adj EBITDA margin. | ||

Uniphar (LON:UPR) (£809m | SR59) | 2025 gross profit +c.9%, with adj EPS +c.21%, ahead of expectations. Remain confident of 2028 target for €200m EBITDA. | ||

Dr Martens (LON:DOCS) (£732m | SR74) | Group revenue -3%, headwinds from reduced promotional sales. Improving trends in US, EMEA revenue down 6% due to shift to wholesale channel. “We are comfortable with market expectations for FY26 PBT.” | AMBER/RED = (Roland) Trading worsened in Q3, as discounted wholesale volumes displaced higher-priced direct-to-consumer sales in a number of markets. When added to the expected impact from tariffs and a growing FX headwind, I think there’s some risk that FY results will end up being slightly below current expectations. More broadly, I am not sure if it’s realistic to expect the company to return to its pre-IPO level of profitability. There could be a turnaround opportunity here, but I’d like to see more concrete evidence of progress before upgrading our view. | |

Capita (LON:CPI) (£466m | SR71) | Three-year extension to UK TV Licensing from July 2027. No financial details provided. | ||

Costain (LON:COST) (£462m | SR71) | Awarded through Regional Delivery Partnership, “worth approximately £100m” over five years. | ||

Sylvania Platinum (LON:SLP) (£316m | SR88) | Produced 24,642 PGM ounces, a marginal increase on the previous (record) quarter. Q2 net revenue +21% to $54.8m, adj EBITDA +35% to $29.8m. FY26 guidance increased to 90 - 93,000 4E PGM ounces (prev. 83-86k). | AMBER/GREEN (Roland - I hold) [no section below] Today’s upgrade to production guidance is positive, although partially offset by delays to the ramp-up of production at Thaba and resulting loss of expected chrome production. However, with PGM prices strong the increase in expected 2026 PGM output should feed straight through to profits. Broker Panmure Liberum has upgraded its EBITDA forecasts by 15% and I don’t see any reason to change our mostly positive view. The only caveat to this is that in my opinion, the valuation (1.8x book value) is now being driven by commodity prices, with little support from intrinsic fundamentals – FY26 EPS forecasts have more than doubled over the last year. Any serious weakness in PGM prices would be likely to prompt a sharp reversal in the share price. | |

Big Technologies (LON:BIG) (£302m | SR34) | FY25 revenue approx £49.7m with adj EBITDA of £24.6m, marginally ahead of FY25 market consensus (£49.1m and £24.1m, respectively). | ||

LSL Property Services (LON:LSL) (£257m | SR53) | FY25 results in line with expectations. Revenue +c.6% to c.£183m, adj op profit +15%. Net cash £27.8m. FY26: “expect another year of profit growth”. | ||

SThree (LON:STEM) (£235m | SR82) | Revenue -13%, pre-tax profit -62% to £25.6m. Dividend held at 14.3pps, net cash £68m. Expect FY26 PBT to be c.£10m. | AMBER ↑ (Graham) The current market cap does seem logical to me: I can't imagine that prior levels of profitability (£40-50m+ per annum) will be seen again for a long, long time. But if any recruiter can emerge from the current difficulties, maybe it will SThree? I can see many reasons for caution here, but also some reasons for hope. On balance, I think that a neutral stance is fair, given that the outlook has not deterioriated since September. | |

Concurrent Technologies (LON:CNC) (£227m | SR74) | New appointment is Jon Jayal, former CEO of AIM-listed Nexteq (LON:NXQ). | ||

dotDigital (LON:DOTD) (£209m | SR55) | FY26 outlook in line with expectations. ARR +13% (+6% organic) to £75.4m, total revenue +4% to £44.2m. | ||

Genel Energy (LON:GENL) (£168m | SR36) | Working interest production -11% to 17.5kbopd. Sold into domestic market at average $32/bbl (FY24: $35/bbl). 2025 free cash flow $4m, y/e net cash $134m. FY26: expect core business to cover its costs, activities in Oman and Somaliland continue. | ||

Evoke (LON:EVOK) (£123m | SR50) | Revenue +2% (£1,786m), adjusted EBITDA in line (£355-360m, up 14-15% year-on-year). Strategic review is ongoing so no forward-looking guidance is provided. | RED = (Graham holds) Revenue is a miss against expectaitons, but adjusted EBITDA is in line thanks to cost control efforts. Unfortunately I continue to suspect that the equity here may be headed for oblivion, with the most recent UK Budget being the final nail in the coffin. Unless management can come up with a disposal that changes the grim outlook? | |

EKF Diagnostics Holdings (LON:EKF) (£118m | SR71) | Revenues +3%, adjusted EBITDA up nearly 10% (£12.4m), in line with consensus forecasts. | ||

Eleco (LON:ELCO) (£110m | SR41) | Revenue +20%, ARR +29% (£34.3m). Cash £16.3m. “Revenue, cash and anticipated adjusted profit are ahead of market forecasts.” Cavendish 2025 forecasts unchanged: | AMBER (Roland) My initial review of this small-cap software company highlights an impressive long-term growth record and high levels of recurring revenue. However, recent cuts to forecasts suggest a more cautious near-term outlook, as does the Falling Star styling. Today’s upbeat remarks on profit are also not fully reflected in broker forecasts, with Cavendish choosing to leave FY25 EBITDA and EPS estimates unchanged today. I think this business looks potentially interesting on a medium-term view, but I’d like to wait for the FY25 results and 2026 outlook before forming a stronger conviction. | |

Time Finance (LON:TIME) (£49m | SR90) | Revenue +4%, PBT +10% (£4.3m). “Significant Board confidence that trading for the current financial year ending 31 May 2026 will be at least in line with market expectations.” | GREEN = (Graham) [no section below] We already looked at the H1 trading update in December and today's outlook statement repeats the company's position that full-year results will be "at least in line". Cavendish forecasts are for EPS this year (FY May 2026) of 6.8p, rising to 7.6p the following year. So if you're comfortable valuing this on its FY May 2027 earnings forecast, the P/E multiple is less than 7x. In balance sheet terms, net tangible assets have risen to £47m; with the market cap around that level currently, I continue to view this as an interesting small-cap financial, with an impressive growth profile. The lending book has risen 12% year-on-year, while arrears measured as a percentage of that book has fallen. Meanwhile, the StockRank is 90 with a ValueRank of 91. Worth looking into, in my view. | |

Lords Trading (LON:LORD) (£38m | SR46) | FY25 revenue +8.3%. Adjusted EBITDA in line. Net debt £14.5m. “The Board maintains its confidence in the strong positioning of the Group for the medium-term.” | ||

Virgin Wines UK (LON:VINO) (£31m | SR85) | H1 revenue +2%, “significantly outperforming the wider online drinks market”. Confident that the FY26 outturn will be in line with current market expectations. | ||

Everyman Media (LON:EMAN) (£26m | SR36) | Revenue +8.7%, FY25 financial performance in line with Dec 2025 update. To reduce net debt, no new venues are expected to open in 2026 (GN note: at last year’s interim results, two new venues were planned for 2026, and another two in 2027.) | ||

Roebuck Food (LON:RFG) (£20m | SR42) | GlasPort Bio achieved first recurring revenues in Q4. Moorhead & McGavin sales fell 11%, still EBITDA positive. Positioned for sales growth and profit recovery in 2026. “Management is looking at various options to optimise the value of our investment in this business.” | ||

Winvia Entertainment (LON:WVIA) (£19m | SR98) | Adjusted EBITDA to be ahead of market expectations at not less than £31 million (exps: £29.1m). Expects to declare a dividend in line with expectations. Strong momentum into 2026. Plans to increase marketing spend on the subscription offering to further increase market share and recurring revenue. | ||

NAHL (LON:NAH) (£17m | SR44) | Revenues +3% (£40m), underlying operating profit +86% (£7.3m). Net debt £3.2m. Trading in 2026 has started well, but “the lower level of enquiries being placed into NAL… will likely result in a lower outcome for the Consumer Legal Services division in FY26 compared to the exceptional results experienced in FY25.” Exploring options to accelerate value for shareholders. | ||

Eco Buildings (LON:ECOB) (£17m | SR14) | Groundworks completed on the first luxury 18-unit apartment development, with construction of the ground floor now underway. This is the first of six apartment blocks of the same size which in themselves are a precursor to a larger villa development at the same site in Albania. Contracted to generate revenues of €2.2m for each apartment block, gross margins 40%. | ||

Xeros Technology (LON:XSG) (£14m | SR21) | Revenue for the year ended 31 December 2025 will come in below market expectations, and costs are slightly above expectations. No impact on outlook for 2026. | BLACK (RED) = (Graham) Today's revenue miss is attributed to two delays: a delay in shipping and a delay in revenue recognition. You might think that revenue slipping from FY25 into FY26 would help to boost the FY26 forecasts, but you'd be wrong! There is no change to FY26 arising from this. At least, thanks to the company's recent fundraise, there's no immediate cash crunch: net cash is expected at £5.6m as of December. I'm still going to put this stock on RED as it has been listed for so many years without delivering, and since the anticipated loss in FY26 (£2.1m of negative EBIT) is still expected to be higher than forecast revenues (£1.4m). If that revenue figure is achieved, it will be the highest the company has managed since 2019. | |

Velocity Composites (LON:VEL) (£10m | SR48) | Revenue in line (down 10%), adjusted EBITDA £1m, net debt £0.1m. "The timing of when aircraft production rates will increase is difficult to predict, however we are focused on ensuring that Velocity is ready to deliver when the global aerospace industry ramps back up to pre-pandemic production levels and further.” |

Graham's Section

SThree (LON:STEM)

Up 6% to 195.7p (£250m) - FY25 Final Results - Graham - AMBER ↑

SThree plc ('SThree' or the 'Group'), the global STEM workforce consultancy, today announces its financial results for the year ended 30 November 2025.

We’ve been really worried about the recruitment sector, and have gradually nudged our view on SThree lower, as its earnings outlook has continued to deteriorate. EPS expectations have fallen to only a fraction of what they were previously:

Which brings us to today’s full-year results.

Firstly, the key points: PBT of £25.5m (down 62%) is in line with expectations. The last trading update was on 16th December, so it would have been a shock to see a further deterioration since then.

Other key points for FY25:

Net fees down 12% like-for-like

Operating profit “conversion ratio” (i.e. operating margin) more than halves to 8.1%, from 17.9%.

EPS down 63% to 13.7p.

Geographically, it looks like this:

DACH (Germany, Austria, Switzerland) down 16% LfL (33% of total net fees)

USA +4% (26% of total net fees)

Netherlands + Spain down 21% (19% of total net fees)

So there’s a really sharp contrast between sharp decline in Europe vs. modest growth in USA and other regions (the Middle East and Asia were up 2%).

In Germany, there were “lower levels of demand for Technology skills, our largest vertical”:

I know little about German politics, but I understand that government spending was supposed to increase after the reform of the “debt brake”:

Germany's performance continues to reflect a challenging trading environment, with the anticipated uplift in job flows from the reform of the debt brake and the government's €500 billion investment fund yet to materialise.

In the USA, meanwhile, there was strong demand for Energy roles:

This reflects sector-wide investment to meet rising electricity demand from AI applications, data centres and electric mobility, alongside ongoing grid hardening to address climate related challenges.

Outlook

The outlook is unchanged with a PBT forecast of c. £10m.

FY25 ended with encouraging new business activity, albeit at historically subdued levels, and good momentum in select markets, such as the USA, underpinning our expectations for the year ahead.

Dividends, buyback

Net cash is still strong at £68m (last year: £70m), and that’s after making a £20m buyback and also paying £18.5m to shareholders.

Since after-tax profit for the year was only £17.7m, insufficient to fund those two shareholder rewards, this means the balance sheet value must have reduced - and yes, there has been a reduction in balance sheet value from £249m to £235m.

That’s still a very large number relative to the market cap (£250m) and it’s mostly in the form of liquid assets (only £73m of long-term assets), so I’d like to think that there is decent balance sheet support here.

But that still doesn’t quite answer the question of how the cash position stayed so strong. I see there was “a favourable working capital inflow, especially stronger cash collections and lower contract assets, partially offset by reduced payable”.

The company has today announced a new £20m buyback and an unchanged dividend.

Management interview

I had the chance to talk to SThree this morning - Timo Lehne (CEO) and Andrew Beach (CFO).

Key takeaways:

They’ve had a tough few years, but they don’t feel they’ve wasted the time, they’ve been preparing for the changes in the staffing industry.

They describe results as showing “resilient, disciplined execution”

They point to growth in 2 of their top 5 countries, and in 4 countries overall

The Technology Improvement Programme (TIP) is completing, setting them up well for the future.

In macro terms, they are obviously waiting for Europe to recover and for confidence to return among their customers.

Looking ahead they are expecting “business as usual” and looking forward to a notable improvement next year; when I pointed to the lower PBT forecast for the year ahead, they responded that this includes the costs of various measures needed over the next year to continue releasing efficiencies, and optimising costs.

Germany: I asked specifically about Germany (Time Lehne is German), and weak German demand in the tech sector. He said that for many years German industry is under pressure from global competition (Asia/US) and that the environment to scale a business competitively in German has not been there. At the same time, he thinks there are signs of slow recovery. The EU has just signed a trade deal with India.

Timo mentioned the IFO index, a German measure of business confidence (GN note: it is very weak, but maybe there are some silver leanings within it. At least it didn’t deteriorate further last month.) The German state itself is keen to spend hundreds of billions on energy and infrastructure. But of course nobody knows how fast a recovery in Germany might be.

Structural change in recruitment: I asked if recruitment as a sector has been disintermediated by new hiring tools. Timo appears to agree that there has been structural change, but also believes that SThree has been preparing well for this new situation and is ready to operate in a new world. Much of the recruitment sector is “analog” but SThree is not - it has brand new technology. And it’s ready to find new ways to serve its customers with a mix of staffing and consultancy services.

Cash: noting that the company is paying out more to shareholders than it is earning in profits, I asked CFO Andy Beach if the company publishes average cash levels, or high and low cash levels. He said they do publish quarterly cash balances and that there can be a £30 - 35m monthly cash swing from top to bottom. He also said that their year-end figure (for November) tends to be a seasonal high, which strikes me as an important fact to be aware of. September is the seasonal low.

He also reminded me that SThree’s cash is counter-cyclical with growth: when they grow it creates a cash burn, and if they are not growing, cash comes back to them. (GN: this is consistent with the company citing “lower contract assets” as a reason for having a high cash balance currently.)

Andrew said that they need a buffer of about £30m, but above that it’s surplus.

Graham’s view

Many thanks to Timo and Andrew for taking the time out of their busy schedule today to help enlighten me. I hope my notes have helped you to understand a little more about the company and the industry, too.

The last time we mentioned SThree was in September, at the profit warning, when Mark downgraded our stance to AMBER/RED.

I’m happy to give a one-notch upgrade today on the following basis:

The results and outlook are in line with expectations.set in September.

The company does still have surplus cash meaning that it can afford to maintain the dividend and carry out the new buyback.

Some geographic diversification including exposure to the much stronger economies away from Europe.

But there are also good reasons to be cautious:

The shares are now expensive relative to short-term earnings, £10m PBT forecast vs. £250m market cap.

I think shareholder returns will have to slow down at some point, unless profits bounce sharply. In round numbers: they have about £70m of net cash at year-end, and suppose they return almost £40m to shareholders via dividends and buybacks again. That leaves them with only £30m (their required buffer) plus whatever cash flow they generate this year.

Economic recovery in Germany still seems nebulous and the outcome of structural change in the staffing industry is still unclear.

So AMBER is the best I can do here. There is no doubt in my mind that restoring profitability will be an enormous challenge.

In that sense, the current market cap does seem logical to me: I can't imagine that prior levels of profitability (£40-50m+ per annum) will be seen again for a long, long time. But if any recruiter can emerge from the current difficulties, maybe it will SThree?

Evoke (LON:EVOK)

Down 9% to 24.9p (£123m) - FY25 Full Year Trading Update - Graham - RED =

(At the time of publication, Graham has a long position in EVOK)

evoke (LSE: EVOK), one of the world's leading betting and gaming companies with internationally renowned brands including William Hill, 888 and Mr Green, today announces a post-close trading update for the three and 12 months ending 31 December 2025 ("Q4" and "FY25" respectively).

I’ve already mentally written this down to zero, but let’s see if there is any chance of a positive outcome anyway.

For anyone who is new to the story: when it was known as 888, this company paid nearly £2 billion for William Hill, back in 2022.

This turned out to be a bad deal, with too much debt involved, and it has been downhill ever since:

The debt associated with buying William Hill hasn’t been the biggest problem the company has faced, but in my mind it’s the biggest.

There have been other problems over the years, such as failures with anti-money laundering processes for Mid East clients, which resulted in the loss of the CEO in 2023.

But let’s turn to today’s news:

Q4 revenue was up quarter-on-quarter but down 3% year-on-year “as a result of the strong comparative period with operator friendly sporting results in the prior year”.

FY revenue expected to be c. £1,786m. This appears to be below expectations (£1,821m on the StockReport).

However, adjusted EBITDA is said to be in line at £355-360m, up 14-15% year-on-year.

I do get the impression that management have been trying to control costs, and the “in line” EBITDA result despite the revenue miss does back that up:

No forward guidance:

As previously announced on 10 December 2025, the Board is undertaking a review of the Company's strategic options, including the consideration of a range of potential alternatives to maximise shareholder value. This includes, but is not limited to, a potential sale of the Group, or some of the Group's assets and/or business units. Accordingly, while this review remains ongoing the Board does not consider it appropriate to provide forward-looking financial guidance at this time. The Group will update the market on the progress of the strategic review when and if appropriate and will issue its full year results in due course.

Graham’s view

This is in dire straits, with a strong possibility that the value of the equity is headed for oblivion. Of course I’ve been saying this for some time.

At least there is the slim chance that management will come up with a deal that changes the rather bleak outlook. For example, could they find a buyer for William Hill?

Net debt was £1.8 billion at the interim results. They would need to find someone willing to pay a rather full price for that business (as they did, when they bought it), in order to get back on even keel.

However, I fear that the last nail in the coffin might be the most recent UK Budget. While they did raise the possibility that they could increase market share “with the likely exit of smaller operators”, they also said at the time:

Prior to any mitigating actions and based on the Board's expectations for gross gaming revenue ahead of today's UK Budget announcement, these changes in tax rates would increase duty costs by approximately £125-135m on an annualised basis once fully implemented from April 2027, with approximately £80 million of the pre-mitigation impact arising in FY26 given the timeframe for implementation.

The Group currently expects to be able to mitigate approximately 50% of the impact from higher duties over the medium-term through supplier savings, reduced marketing, retail store closures, operating cost savings, and potential changes to the customer proposition.

So we are talking about a £60m+ annualised hit even after mitigation, with the mitigation efforts likely to result in a smaller overall business.

I don’t think they can afford that kind of hit. I should really have sold my EVOK shares by now, but they are such a small percentage of my total portfolio that I’ve been in no rush!

Roland's Section

Eleco (LON:ELCO)

Up 13.6% at 150p (£125m) - Year-End Trading Update - Roland - AMBER

This small-cap software company provides systems to help with the design, construction and management of buildings. Eleco is one of the top risers on the London market this morning, after guiding for “revenue, cash and anticipated adjusted profit” to be ahead of market forecasts in its year-end trading update.

Today’s key headlines (y/e 31 Dec 25):

Total revenue to be +20% at £38.8m (+19% constant currency)

Annualised Recurring Revenue +29% to c.£32.4m

Recurring revenue 81% of total revenue (FY24: 77%)

Net cash of £16.5m, no debt

Outlook & updated estimates: apart from the comment above, there is no specific mention of 2025 profits in today’s update. There is no specific guidance for 2026, either.

Fortunately, house broker Cavendish has issued an updated note today – many thanks. This sheds some light on the situation, but not exactly as I was expecting.

2025 estimates: Cavendish’s analysts have made slight upgrades to revenue and gross profit, but adjusted EBITDA and EPS estimates are unchanged:

FY25E revenue: £38.8m (+4% vs previous)

FY25E gross profit: (+2% vs previous)

FY25E adj EBITDA: £9.1m (unch)

FY25E adj EPS: 5.4p (unch)

Cavendish’s forecasts suggest that the small increase in gross profit will be offset by higher overhead costs, resulting in a flat result overall.

However, today’s broker note does acknowledge “the update highlights that adjusted profit is expected to be ahead of expectations, and that FY25 adjusted EBITDA is expected to be announced at FY25 results.”

My reading of this is that Cavendish's analysts aren't quite sure where the outperformance on profit will come from, based on today’s update and any other discussions they may have had with management.

2026 estimates: more understandably, Cavendish has left its 2026 forecasts unchanged today ahead of the publication of Eleco’s 2025 results.

FY26E revenue: £43.9m

FY26E adj EPS: 6.6p

Roland’s view

Checking back through the archives, I can see we haven’t covered Eleco for some time. A look at the 10-year chart suggests this may have been an oversight. This stock has been an impressive multibagger on a long-term view, up by c.530% over the last 10 years. Congratulations to holders who have spotted this opportunity:

More recently, the StockRank has fallen steadily and the shares have dropped from recent highs, earning Falling Star styling:

Broker estimates have indeed been trimmed over the last year, especially for 2026 (for which no guidance was provided today):

2026 EPS estimates are now 15% lower than they were in March 2025.

I haven’t followed this company over the last year, but it looks like estimates were downgraded after the publication of the company’s full-year results (May) and interim results (September).

Interestingly, the cut to forecasts following September’s interim results came despite the company issuing an “in line” outlook statement.

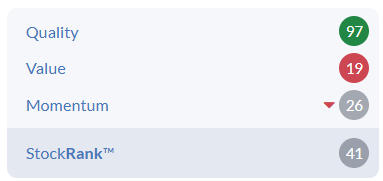

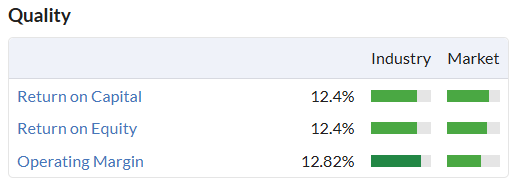

Quality: there doesn’t seem to be anything fundamentally wrong here. The balance sheet looks healthy and quality metrics are quite good, reflected in the high QualityRank:

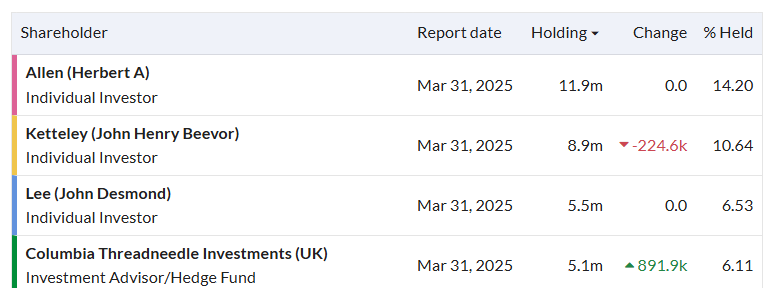

Shareholders: checking the shareholder register, I can see that the top three shareholders are all individual investors. I don’t know the history here, but my understanding is that John Ketteley is a former CEO and chairman of the company. A quick Google suggests Herbert Allen and John Lee (not UK investor Lord Lee) are both US businessmen and investors:

Looking at the current board, neither the CEO (in charge since 2020) nor the chairman (appointed 2023) appear to have a reportable stake in the company.

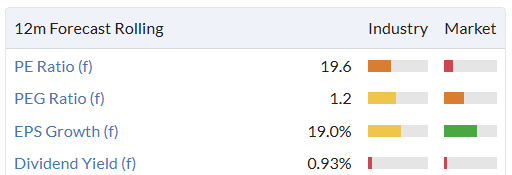

Valuation: a ValueRank of 19 is not very encouraging for an investor like me, with a bias to value. Even using forecast metrics, Eleco does not seem obviously cheap:

The bottom line: this business has a good long-term track record of growth and profitability. Management has built a high level of recurring revenue that should underpin stable, reliable cash flows.

Profitability is very respectable (although not outstanding) and cash generation appears to be good. The balance sheet looks strong to me, with more than 10% of the share price covered by net cash.

On the other hand, recent broker sentiment has been cautious and my initial impression is that the valuation could be up with events. I am inclined to take a cautious view of today’s upbeat remarks, given that the company’s own house broker has not chosen to update its own 2025 profit forecasts.

I look forward to seeing the 2025 full-year results and reviewing 2026 guidance. I would like to be able to take a more positive view on Eleco and believe this could be justified, but I don’t feel there’s enough evidence in this update to pull the trigger just yet.

Dr Martens (LON:DOCS)

Down 12% at 66p (£636m) - Title - Roland - AMBER/RED

Bootmaker Dr Martens is the top faller in the FTSE 250 this morning, after warning that its strategy to reduce discounting has hit sales.

Today’s third-quarter update covers the 13 weeks to 28 December 2025 and highlights the tension between pricing and volumes.

Wholesalers are seemingly able to drive higher volumes by discounting sales. Unfortunately, this is at odds with the company’s ambition to improve the quality of its revenue (and brand) by increasing the proportion of full price sales. These figures are all on a constant currency basis:

Q3 group revenue 2.7% to £253m

Q3 wholesale revenue +9.5%

Q3 direct-to-consumer (DTC) revenue -6.5%

I think the main takeaway from these figures is that trading worsened during the run-up to Christmas.

Dr Martens’ half-year results showed comparatively stronger figures:

H1 revenue +0.8%

H1 DTC revenue flat

H1 wholesale revenue +2%

While the Q3 wholesale result was stronger than in H1, these discounted sales have come at the expense of much higher margin DTC sales.

Regional results: there was some improvement in the previously troubled Americas division, where revenue rose by 2% (DTC +1%, wholesale +6%).

However, total revenue fell by 6% in Europe despite a slight increase in the number of pairs sold. Again, this highlights the impact of discounted wholesale volumes on the overall result – DTC revenue fell by 12% while wholesale revenue rose by 13%.

The situation in the APAC region was similar, with overall revenue down 3% (DTC -6%, wholesale +8%).

Outlook

The FY26 year ends in March. Management expects revenue to be “broadly flat” on a constant currency basis, so probably slightly lower in reality.

CEO Ije Nwokorie is effectively sacrificing sales in the hope of laying foundations for stronger and higher margin growth in future years.

Despite this, FY26 profit guidance is unchanged:

We are comfortable with market expectations for FY26 PBT, which will result in significant year-on-year PBT growth

No details are provided today, but November’s half-year results included this guidance on PBT expectations and the expected impact of US tariffs:

For FY26 we are trading in line with our expectations and, as of 17 November 2025, the sell-side Adjusted PBT consensus range was £53m to £60m. These figures did not include any impact from tariffs, and we remain comfortable in achieving this range on that basis. We can now give guidance on the impact of tariffs on FY26, and they represent a high single-digit £m headwind. Given the timing of our mitigation actions, we expect to offset roughly half of this impact.

Further to this, today, the company has adjusted its foreign exchange guidance to suggest a “broadly neutral” impact on adjusted PBT, versus a £2m positive impact previously.

After attempting to include tariffs and FX impact, I estimate that FY26 adjusted pre-tax profit could perhaps be in the range c.£49-56m.

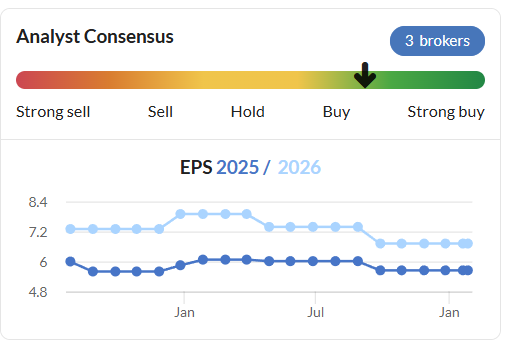

I don’t have access to any updated broker notes today, but I can see that consensus expectations have been stable for some time prior to today’s update:

Based on the EPS estimates above, DOCS shares trade on a FY26E P/E of 16, falling to a P/E of 12 in FY27.

Roland’s view

Investors in Dr Martens’ 2021 IPO have now lost 85% of their original investment. But if FY26 is a turning point and CEO Nwokorie can deliver on his strategy of reducing wholesale reliance, capital-light expansion and controlling costs, then I think there could be a turnaround opportunity here.

Personally, I am reluctant to upgrade our view today. I think there’s still a risk that full-year results will be below recent consensus forecasts. The current valuation – on a double-digit P/E – doesn’t strike me as extremely cheap either, unless profits can recover towards pandemic levels.

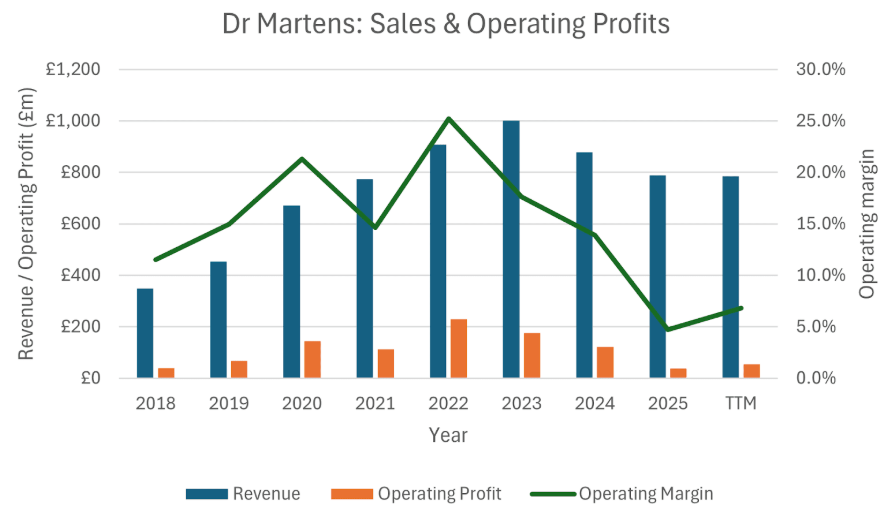

To get some historical perspective on this, operating margins were in low double digits prior to the pandemic boom and 2021 IPO:

If operating margins can rise above 10% once more, then I think the stock could be cheap at current levels given that revenue has doubled since then.

However, I’m not sure how likely this is or how quickly it might happen. The long-term performance of mid-market fashion brands can be hard to predict (or protect).

Given the downbeat tone of today’s update, I am going to leave Megan’s previous AMBER/RED view unchanged until more concrete evidence of progress emerges.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.