Good morning!

I added a section on Ten Entertainment (LON:TEG) late last night to yesterday's report. That report now includes Superdry (LON:SDRY), Equals (LON:EQLS), Alpha FX (LON:AFX), and Ten Entertainment (LON:TEG).

For today, we have:

- Sosandar (LON:SOS)

- Victoria (LON:VCP)

- Somero Enterprises Inc (LON:SOM)

- Marshall Motor Holdings (LON:MMH)

Sosandar (LON:SOS)

- Share price: 14.5p (pre-market)

- No. of shares: 163 million (after Placing)

- Market cap: £24 million (pro forma)

Paul is going to chime in on this, but here are the facts:

- Conditional placing at 15p (less than half of the share price at which it raised money last year).

- Placing shares will represent 28.7% of enlarged share count. Meaningful dilution for existing holders, therefore.

- General Meeting on 29 July to confirm the deal.

Analysis - It's not a huge surprise that Sosandar needs more funds, since cash had reduced to £3.6 million as of March 2019, and it is going to make loss this year while at the same time trying to almost double revenues.

Paul himself put it to management last week that "cash looks set to run out in early 2020", and received a reply he described as "generic".

It must be difficult for management teams in situations where we can see that they need more money, but they need to put on a brave face on things and give nothing away about conversations which might be happening in the background.

While I'm an outsider in this situation, I suspect that it was best to get this Placing away sooner rather than later. It's better to do it before the need for cash becomes desperate. Also, after a disappointing Q1, the direction of least resistance for the share price was downwards. Diluation at 15p might sting, but dilution at 8p after a weak Q2 would be far worse.

The size of the Placing is also quite interesting. £7 million should keep the wolf from the door for a good long time, although that depends on how aggressively the company chooses to spend it. Sosandar says that it will:

- support working capital expansion (including: inventory for sale on 3rd-party sites, less reliance on supplier credit, wider product range)

- increase customer acquisition (increasing future revenues thanks to repeat orders - once a customer has been acquired, it is likely to come back and shop again without the same expensive marketing effort).

My view - well done to Sosandar for raising these funds and giving itself much more flexibility over the next couple of years.

Let's remind ourselves how much cash it has raised: £5.3 million in Nov 2017, £3 million in October 2018, and £7 million today, for a total of £15.3 million.

If you believe that these funds have been spent wisely so far, and will continue to be spent wisely, then it's not a stretch to think that a market cap of £20 million+ could be justified.

The company says today that it might not meet the requirements of VCT (venture capital trust) legislation. Fundamentally, however, I still think this is much closer to a venture capital type of investment than a regular stock market investment.

One further thought: Given the company's massively increased spending power, I think that we should (all else being equal) see large upgrades to forecasts, since the company has so much more cash to spend on marketing and inventory for both this year and next year.

Therefore, if we don't see any upgrades to forecasts, I think it's fair to treat this as a sort of "stealth downgrade". The old forecasts were based on the company's existing cash resources, not including an extra £7 million and an acceleration of spending.

Paul's view:

The Q1 update seemed weak, at only 23% Y-on-Y revenue growth, so I rang the company. The explanation they gave (poor weather, so slow sales of summer clothing, hence they deferred marketing spend) makes sense to me. With better weather, and normal marketing spend, they might have been perhaps 50-60% up Y-on-Y, but I don't see that they would have hit the 100%+necessary to meet this year's forecast.

I've spoken to them again, in more depth since, and they are adamant, and very confident, that they will hit this year's forecast, because they're planning for a monster autumn/winter (A/W) season.

At this point, I need to apologise to a subscriber here called "thirty fifty twenty" (can't remember if that's the right order!) for a rather snappy reply I posted here on results day. He speculated (wrongly at the time) that I may have been made an insider & hence couldn't comment.

So imagine my surprise, when my broker rang me on 5 July, to ask in the usual way, if I wanted to be made an insider on a fundraising. That's the way it's done, on a recorded line, I have to give specific consent to be made an insider (which only happens rarely). My broker screens out all the junk that I wouldn't be interested in (e.g. junior resource stocks), and only offers me placings in companies that fit my investment criteria (retail, eCommerce, decent profitable companies, and things I'm currently or previously invested in). I've used this broker for over 15 years, so he knows exactly what type of stocks I like.

When my broker said the company raising funds was Sosandar, I was very surprised. Although the vague answer that the company gave me (which I wrote about on 3 July here) about cash requirements now made sense! At the time we spoke, the company was putting together a fundraising, but couldn't tell me at the time.

Anyway, with placings you usually meet the company, and have a confidential meeting. I couldn't get into London, so dialled in to the meeting on a conference all, and just listened.

The tone of the meeting was very upbeat, which surprised me, as this looked initially like a distressed fundraising - after relatively poor growth in Q1. So I was expecting it to be done at c.10p, and put in a fairly big order anticipating that sort of price.

I was very surprised when my broker messaged me to say that there was very strong demand, and the placing would be done at 15p. My order was scaled back to about half, as were others, the placing was significantly over-subscribed. That's encouraging, as it means that the depressed share price (it recently bottomed out at c.12.5p I think) reflects negative sentiment by small shareholders trading in the market, but definitely does not reflect the more positive views of institutions & other large shareholders (who typically don't transact in the market through market makers, so they have little to no influence on the share price).

Back to the meeting, I remember starting the call feeling rather negative about things. Why was the company raising more money, when the share price had dropped by about two thirds from its peak? What a pity shareholders are being diluted (although not disastrously so).

After an hour on the phone, things felt much more positive. Management explained that Q1 was only a small part of the overall forecast for this year, so it really didn't matter particularly that growth had slowed to +23% in the quarter. The key season was the upcoming autumn/winter season, and the company has big plans for this. Specifically;

Large expansion of the product range. We've seen with BooHoo how range expansion feeds through pretty directly to increased sales (i.e. if you double the product range, then sales roughly double too). SOS is planning to roughly double its range this A/W

Increased design/buying team - new (talented) designers have been employed recently, to focus on specific product areas where the company sees strong growth potential - namely denim (there's been a recent influx of new denim styles on the website): https://www.sosandar.com/catalogsearch/result/?q=denim

Also, a large expansion of accessories ranges is in the pipeline, with a new buyer. Leather & knitwear are other ranges that are being greatly expanded too.

These areas have been picked for key reasons, e.g.: lower returns rates on those products, high cash margins, less seasonality (e.g. denim sells all year round) hence should make sales less weather dependent in future. I think that's a very clever strategy.

At the moment, about 50% of sales are dresses, as you can see from the website that is the main product area, with lots of choice. The returns rate is high on dresses, because it's a complex fit. Therefore the focus is to grow the other areas mentioned above, which should gradually reduce the returns rate from the current rather high rate of c.50%. Although 40-50% is the industry average, for womenswear. Which stands to reason - when we try on clothes in a fitting room of a physical shop, we typically buy half, and put half back. So why would online shopping be any different?

With denim in particular, there's an aspiration to become a go-to shop for denim, with customers coming back again & again to buy their favourite style of jean, or denim dress. TopShop are said to be very strong on demin for a younger customer. Sosandar want to "own" this area for their demographic, which could be lucrative if they pull it off.

Footwear and active wear are other areas where new buyers have been brought in. So clearly the company has very ambitious plans for A/W.

CFO James Bowling explained that the new buyers have brought with them existing supplier relationships, therefore a large broadening of the supply base is taking place. That's great, and will mean higher gross margins, but it also puts a strain on cashflow. New factories require up-front payments, whereas his existing forecasts planned for credit terms from suppliers to increase.

The other pressure on cashflow is that suppliers all over the world are very nervous (understandly) about supplying UK retailers, because of the spate of CVAs & other financial problems - e.g. Arcadia, House of Fraser, Debenhams, and plenty of others all having to financially restructure. The withdrawal of trade credit insurance on UK retailers is another issue.

Therefore, to fund the greatly increased A/W ranges, Sosandar needs more cash. Plus of course it has ongoing trading losses to be funded by shareholders.

Another growth area is online platforms. Previously, the company sold only through its own website. A decision has been made to start selling a few key styles through third party fashion websites. This will clearly put Sosandar's products & brand name in front of a very much larger audience.

Margins are much lower on third party sales, as it's wholesaling basically. The online platform takes most of the profit. However, there's no marketing expense this way, so new customers (potentially large numbers) are recruited at zero cost. If the Sosandar styles sell well, then the online platforms promote Sosandar through their customer emails, etc. I'm delighted that Sosandar is going down this route, and it could really turbocharge growth.

Marketing - they want to step up a gear here too, which obviously costs money. New areas being launched include sponsoring celebrity & influencer podcasts (e.g. white wine question time by Kate Thornton), and screens on escalators on the tube.

New customer acquisition is driven by marketing spend. they didn't try to acquire new customers in Q1, due to poor weather - the ROI would have been poor, so they dialled it down. This is a very nice feature of online businesses. I think private investors saw this as an excuse for lacklustre growth in Q1, which is a bit unfair in my opinion.

Although I have a hunch that there were some product issues in Q1 which might have impacted sales growth. I'm sanguine about that, because most small companies experience growing pains along the way.

International expansion is also being considered. The company already does international delivery, although I don't know what % of current sales are overseas. Probably very small, as no overseas marketing has been done. However Sosandar says it has "got our eyes on America" - which would only be a specific region initially. If you look back at Asos & BooHoo in the early days as listed companies, their share prices really went through the roof when international expansion began to gain traction. Maybe the same could happen here in due course? It's nice upside potential anyway.

Repeat custom - management really stress this area as being very exciting. Once customers buy from Sosandar, many return to buy more. Hence sales will snowball over time. Another great benefit of repeat custom, is that the product returns rate is much lower, about 35% instead of 50%.

My opinion - I've always been very bullish on this stock, because the concept is excellent (product designed & targeted to suit an under-served demographic of 35-55), and management really know what they're doing.

I think Sosandar made the same mistake that almost all small, growth companies make in the UK - not raising anywhere near enough money. Forecasts always seem to under-estimate the amount of money, and the time needed, to achieve scale. In fairness to Sosandar, it actually beat the very aggressive growth targets last year.

The only disappointment has been Q1 of this year, but management are absolutely adamant that it's not a problem, and the full year target of £9.3m is definitely achievable. Third party sales is extra business on top of the existing forecasts, as Graham points out above. Although personally I would expect that to start small.

The £7m placing greatly de-risks things. In the past, management didn't want to dilute themselves & others, but on reflection that was a mistake. We can't go back and change that, so dilution at 15p is disappointing, but in return we're getting a much better business, with strong funding, which can execute growth more aggressively. That's clearly very positive.

So the road's been a bit bumpy here, but I'm very positive on the outlook for the company, over the long term. How it's valued in the short term, who knows? That's up to market sentiment. I'm thinking longer term with this, and expect it to be a very much larger business (and strongly profitable) in 5 years' time.

It's not without risk of course. If the company doesn't generate the planned growth, then it could run out of money again in maybe 2 years' time, and get into a death spiral of increased dilution at lower & lower prices. So it's not one for widows & orphans, obviously. You don't usually get multi-bagger potential without increased risk.

Back to Graham.

Victoria (LON:VCP)

- Share price: 477p (-3%)

- No. of shares: 125 million

- Market cap: £598 million

Victoria PLC (LSE: VCP) the international designers, manufacturers and distributors of innovative floorcoverings, is pleased to announce its preliminary results for the year ended 30 March 2019.

The Executive Chairman addresses the fall in share price over the past 12 months, putting it down to three factors:

- The aborted bond issuance in November 2018. "Due to poor communication, for which your chairman takes responsibility, the equity market took fright." See this report for detailed analysis by Paul and myself of events at the time. Then see this report for Paul's Q&A with the Chairman.

- Cyclical UK flooring market was "challenging" in FY 2019. Victoria chose revenue and market share gains as a competitive strategy, instead of maximising earnings. It says that this will "permanently benefit the Group".

- Australia - mortgage lending criteria tightened and house prices declined, hurting consumer confidence.

An interesting admission that the VCP share price has sometimes got ahead of itself:

..it is only fair to note that there have also been times over the last six years when the share price growth has outpaced the growth in the underlying value of the business. However, over time, these two figures should more-or-less track each other and therefore we remain confident Victoria will continue to create wealth for its shareholders.

Acquisition Strategy

This company has been built via acquisitions. Victoria delegates "full operational authority and responsibility" to the managing directors of its subsidiaries.

That's a winning strategy - see Berkshire Hathaway (BKR)! (in which I have a long position)

The Chairman goes into some detail about the achievements of his MDs.

Elements of the acquisition strategy:

- doesn't buy turnarounds (same as BRK!)

- focused on free cash flow, so it wants the factories it buys to already be modern and well-equipped.

- wants to find committed, talented, honest management

- broad distribution channels, avoiding customer concentration. Good!

- buying at a fair price. The Chairman quotes Buffett on this!

EBITDA

This is extremely important:

"[EBITDA metrics are] not the methodology we use internally to assess value. Internally we focus on the free cash flow return, with EBITDA as a waypoint, not the finishing line. We adjust for depreciation (not necessarily the accounting depreciation, but rather the actual assessed cost of maintaining the required level of fixed assets on an accrued basis), working capital - and taxes, which vary significantly between jurisdictions. Identical EBITDA numbers from two different businesses can produce vastly different amounts of cash."

Goodwill

I also agree with this:

"Some investors like companies with a high percentage of tangible assets on the balance sheet on the basis that they somehow underpin the value of the equity. Victoria's board does not share this view for two reasons: firstly, we think this assumption provides a false sense of security as tangible assets rarely, if ever, achieve their stated book value in a distressed sale, and secondly (and far more importantly), companies who need a high level of tangible assets to generate their earnings will, when achieving organic growth, almost certainly consume vast amounts of cash 'investing' in the additional assets needed to support that growth. The result is a poor return on capital. Needless to say, this prospect holds little appeal for Victoria, who would rather deploy the cash more productively."

While I always check the value of tangible assets on the balance sheet, and prefer companies with more tangible value rather than less, I actually agree with this paragraph. It's better to have a few, high-quality tangible assets capable of growth rather than more, low-quality tangible assets.

Net debt

Net debt was c. £340 million at year-end, in line with forecasts.

I've noticed a pattern - the Chairman enjoys taking aim at bad commentators!

There is no such absolute measure as "too much leverage" and we have been surprised by how simplistic (or 'lazy', if one was being less kind) some commentators' thinking is in respect of leverage: A generic multiple of X times EBITDA is "too high" for a business, Y times, is "ok". That's a bit like saying everyone who weighs 90kg is fat. That might be true of a 1.6m tall pastry chef, it probably isn't true of a 1.9m rugby player.

Again, I agree with his assessment of financial theory. The stability of cash flows to service the debt is what counts.

Net debt/EBITDA is now 3.2x, after an expensive acquisition, which is at the top end of the range for Victoria. A rapid deleveraging is needed before the company makes another large acquisition.

The company is again looking at bond issuance to replace th facilities provided by banks. As I said last year, I think that would be a smart move.

Dividends

Victoria has no intention of paying a dividend for the foreseeable future, saying that more wealth will be created by deploying free cash flow within the Group. Dividends create a tax problem and are illogical if the company occasionally wishes to raise equity from shareholders.

I've raised these points myself and couldn't agree more with the logic presented here.

Results

Like-for-like revenue growth is 2%, with UK & Europe soft flooring +7% but Australia minus 7%.

There is a reported loss of £8 million, after more than £50 million (pre-tax) of adjusting items. This includes a horrible £7 million spent on the attempt to issue a bond. Adjusted earnings are £43 million.

My view

I'm intrigued by this share. I previously wrote it off, on the basis that the sector (floorcoverings) and the strategy (debt-fuelled acquisitions) were of no interest to me.

However, I can now see the logic underpinning the strategy. Indeed, I think the Chairman's arguments are unassailable.

I need to do more due diligence into this one. It has piqued my interest.

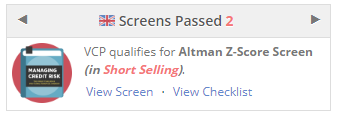

As a health warning, the Stocko algorithms are unimpressed. VCP qualifies for short-selling screens related to bankruptcy risk and overvalued, poor quality earnings:

Somero Enterprises Inc (LON:SOM)

- Share price: 285p (-2%)

- No. of shares: 56 million

- Market cap: £160 million

No news here, this trading update is in line with expectations.

The recent profit warning wiped out most of this company's share price gains since early 2017.

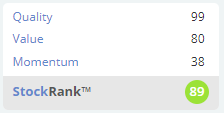

It's a great entry point for those who've been watching it for a while, waiting for better value, especially those who follow a "QV" style. The question is whether the heavy rainfall which caused the profit warning was a blip, and not the start of something more serious. Here's the Stockrank:

Aside from company-specic analysis, you need some confidence in US construction activity trends, to beef up the investment thesis.

£MMH

- Share price: 145p (unch.)

- No. of shares: 78.2 million

- Market cap: £113 million

Marshall Motor Holdings plc, one of the UK's leading automotive retail groups, issues its pre-close trading statement ahead of the release on 13 August 2019 of its half year results for the six months ended 30 June 2019 ("H1" or "Period").

This is in line with expectations.

MMH confirms that the new and used car markets remain challenging, but says it has outperformed the competition.

Financial position - very positive signals on this front in terms of cash generation.

Outlook - an unchanged outlook, despite concerns over political uncertainty, retail cost headwinds, and possible vehicle supply issues arising from the implementation of more anti-emissions regulation in September.

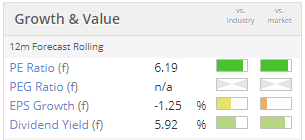

My view - this may offer value at a forward P/E ratio of 6x and yield of almost 6%. I think there is a rule about finding companies whose yield is higher than their P/E ratio, and MMH is almost there!

Propects for growth and a re-rating of the share price may be limited, but it could suit those who are happy with yield.

Calling it a day there, folks. Enjoy the sunshine!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.