Hello, it's Paul here.

It's busy for updates today. Please see the header above for the stocks that I shall be reviewing today.

Elegant Hotels (LON:EHG)

Share price: 85.5p (down 10.9% at 08:32 today)

No. shares: 88.8m

Market cap: £75.9m

(at the time of writing, I hold a long position in this share)

Results - for year ended 30 Sep 2017. This company is;

...the owner and operator of seven upscale freehold hotels and a beachfront restaurant on the island of Barbados.

It listed on AIM in May 2015. This is a rare exception to my usual (personal) blanket rule not to invest in overseas companies on AIM. The reasons being that it's profitable, has freehold property assets, pays divis, seems to have sensible management, and operates in a country which seems to be politically & economically stable.

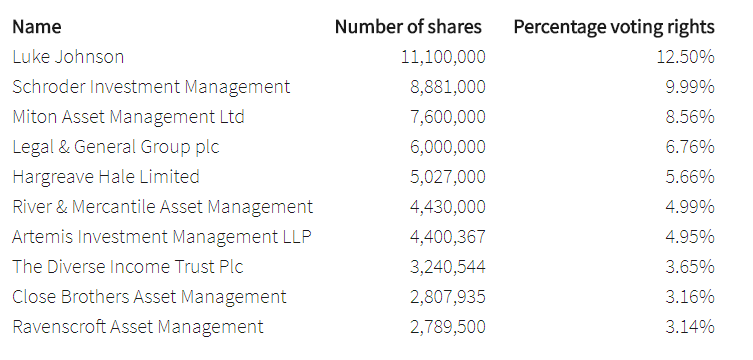

Its major shareholders list is pretty impressive too;

Results today have clearly underwhelmed some people, as the share price down 10.9%.

Dividends have been reduced today, which could have upset some shareholders. Although as I flagged here on 12 Oct 2017, the company was clearly over-paying, so a cut in the divi was to be expected. The final divi this year will be 1.75p (PY 3.5p). The 2018 divi will be 4.0p, split one third: two thirds between interim & final. That will still give a pleasing yield of 4.7%, and looks a much more sensible level of payout. So personally, I'm absolutely fine with this. I'd much rather the company sensibly balances its divis and capex, rather than paying out too much in divis and starving its hotels of capex.

Some key numbers for 09/2017;

- Revenue up 5.1% to $59.9m - with one additional site.

- Adjusted EBITDA down 7.6% to $18.1m - so nicely cash generative, but we do need to take into account maintenance capex, which is heavy for hotels.

- Adjusted profit before tax is down 22% to $11.1m

- Adjusted basic EPS is down from 13.1c last year, to 10.1c this year (converts to sterling of 7.5p). Note that there doesn't seem to be any potential dilution from share options, since the basic & diluted EPS figures are the same.

- At 85.5p share price, the 7.5p EPS results in a PER of 11.4

- EPS seems to have come in below the $0.11 consensus shown on Stockopedia. However, Zeus Capital says in an update this morning that the result is slightly above its expectations.

Forex - this is the key issue for the company, which we already knew about. Something like 70% of the company's revenue comes from British tourists, but its costs are in US dollars. So the devaluation of sterling has been a headwind.

The company gives refreshingly clear guidance about this issue;

This was the first full year of a rebased Sterling/USD exchange rate. As a result, given Elegant Hotels' rates are priced in USD while the majority of its customers are from the UK, it has been necessary for the Group to discount rates at certain of its properties on a targeted and tactical basis. This has inevitably affected the profit margins of the business, but the Group believes that the pricing environment is now much more stable.

As such, these market conditions should be seen as the new normal.

Balance sheet - as you would expect, since it owns freehold properties, the balance sheet is dominated with PPE (property, plant & equipment), of $183.7m. Hotels don't tend to have much working capital, so the only other big item is borrowings, with net debt being $73.1m. That seems a fairly conservative level of gearing, on a loan to value basis of 39.8% - assuming that properties are actually worth book value.

Zeus Capital say that the freehold properties were valued at more than book value in 2016, and quote a NAV of 163p. I'm a bit sceptical about valuations on hotels, as they often don't seem realistic.

Looking at book values on the balance sheet, net tangible assets of $109.7m converts to £81m, which is higher than the market cap of £75.9m. So providing you're happy with the book value of the freeholds, then this share appears very solidly underpinned.

It would be worth checking out the terms of the loans, although I won't bother now, because I'm happy with the relatively modest level of gearing.

Overall, this balance sheet looks OK to me, I don't have any concerns.

Outlook - sounds fine to me;

Trading since the start of the new financial year has remained in line with market expectations, and our bookings are currently tracking ahead of the same period last year. As a result, the Group remains confident in its prospects for 2018 and beyond.

Broker forecasts - Zeus has reduced its profit forecasts by about 16% today, which is rather surprising, since the forex issue was already known about. Therefore it's probably safest to not expect much in the way of earnings growth, assuming forex rates remain unchanged.

My opinion - I haven't read through the narrative yet, as there's lots of other stuff to get through today. However, based on the figures, I'm happy to continue holding this share. There's a reduced, but still good dividend yield. Plus there's strong asset backing, and potential bid activity - note that here on 4 Dec 2017 the company announced a failed bid approach from Melia Hotels International. It's not clear from the announcement why those talks did not progress to a cash bid.

Overall, I think this share looks a reasonable each-way bet - I can continue to hold for the dividend income, and at some point there might be the bonus of a takeover bid. I'm not inclined to buy any more though, because the earnings outlook seems rather lacklustre, with limited growth potential in the short term anyway.

Topps Tiles (LON:TPT)

Share price: 86.2p (up 7.8% today)

No. shares: 193.1m

Market cap: £166.5m

(at the time of writing, I hold a long position in this share)

Topps Tiles Plc (the "Group"), the UK's largest tile specialist, announces a trading update for the 13 week period ended 30 December 2017.

This looks a pretty solid performance, hence why the share price has risen nearly 8% today;

Like-for-like revenues for the first 13 weeks of the current financial year increased by 3.4% (2017: +0.3%)

Outlook - the company sounds cautious, but it's now up against some nice soft prior year comparisons, so I wouldn't be surprised to see it continue to report decent LFL sales growth throughout 2018.

While we are pleased with the like-for-like sales growth achieved in Q1, we are retaining our prudent view of market conditions for the year ahead."

New division - this bit caught my eye, and I like the sound of this;

In parallel with our growth strategy for our core domestic business, we are progressing the development of a new division targeting the commercial tile market. Building on the acquisition of Parkside Ceramics in September 2017, we are investing in the capabilities necessary for future growth. The Parkside commercial offer was launched at the 100% Design trade show in October and our first commercial showroom opened in Chelsea in December.

That sounds as if there might be some up-front costs incurred, but the aim being to drive future growth. This sounds interesting, as it could perhaps be the trigger for a re-rating of this share onto a higher PER multiple?

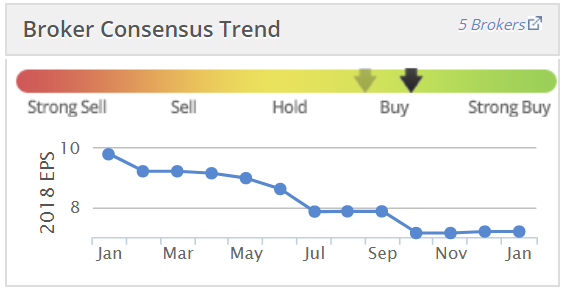

Valuation - Stockopedia shows broker consensus of 7.19p EPS for 09/2018. However, broker commentary today suggests that forecasts could be moving upwards, which is a potential change of trend from the reductions in the last 12 months;

My opinion - as mentioned in my last report here on 4 Oct 2017, I'm warming towards this company. Consumer spending seems to be pretty solid, based on surprisingly good reports so far from retailers. Hence why I think this could possibly be quite a good entry point for modestly valued retailers which are reporting positive trading now.

There's an attractive dividend yield with this share too, still over 4%, even after today's rise. I don't expect this share to shoot the lights out, but it looks to me as if it's possibly set up for a better performance in 2018 than in 2017. Overall then, I'm moderately positive about this share, hence why it's now in my personal portfolio.

Joules (LON:JOUL)

Share price: 309p (unchanged today, at 10:54)

No. shares: 87.5m

Market cap: £270.4m

Joules, the British premium lifestyle brand, today updates on the Christmas trading performance of its retail business for the seven-week period to 7 January 2018.

This company issued a totally unsatisfactory trading update which I criticised here on 12 Dec 2017, which failed to inform investors properly. Anyway, they've done exactly the same thing again today - giving inadequate information, saying only;

Joules delivered a strong performance over the Christmas period with total retail sales* up 19.2% against the comparable period last year. This was driven by continued growth across both the Store and E-commerce channels.

Retail gross margin, over the same period, is expected to be in line with the prior year as we maintained our disciplined and selective approach to promotional activity.

Plus there's another short paragraph of complete waffle, which I haven't copied here.

Where is the key information on like-for-like sales? It's not given. Total sales is too vague, because the number of shops has increased from 107 to 117, therefore costs will have also increased, and we don't know by how much. The timing of those new store openings will have obviously determined the total sales increase, plus the (undisclosed) key figure of LFL sales growth. Very unsatisfactory reporting.

Nothing is said about profitability versus market expectations either - again a glaring omission. A trading update which omits this key information is not a trading update at all.

Broker updates - the company clearly has briefed the analysts with the numbers, because broker updates are coming out this morning with increased profit forecasts for this year. I understand obviously that analysts are going to get more detailed information than the rest of us. However, to withhold the key performance indicators of LFL sales, and profitability versus market expectations, from a trading update, whilst simultaneously briefing analysts with information that results in them upgrading their forecasts, seems to me very wrong indeed.

This is a two-tier reporting process, where only privileged individuals who can get access to broker notes, are told the true picture. Whilst the rest of the hoi polloi are left mostly in the dark, and have to wait until the interim figures are reported on 31 Jan 2018. That gives a privileged few in the City almost 4 weeks to buy the shares, knowing that the results are going to be good, whilst everyone else is largely left in the dark.

My opinion - this share looks expensive on a forward PER basis, but that's partly because the company seems to be trading well, and profit forecasts are likely to continue trending upwards. The current format of its trading updates is appalling, and needs to be revised so that all market participants are made aware simultaneously of key performance metrics. That's what is supposed to happen, but unfortunately with this company, the rules are not being adhered to. Just announcing a total sales figure, with no indication of LFL sales, nor performance against market expectations, results in trading updates that are so vague they're almost useless.

Maybe it's time to get rid of the PR people, and bring in more investor-friendly advisers?

Good company, lousy reporting.

Nexus Infrastructure (LON:NEXS)

Share price: 235p (unchanged today, at 11:40)

No. shares: 38.1m

Market cap: £89.5m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 30 Sep 2017.

Nexus, the leading provider of essential infrastructure services to the UK housebuilding and commercial sectors...

For anyone not familiar with this company, which floated on AIM in Jul 2017, I wrote an initial review of it here on 25 Oct 2017.

To save me typing, here is a picture of the financial highlights. As usual, I'll double-check to make sure they're not cherry-picking the nice things, and glossing over the not so nice, as lots of companies do!

Whilst the company says that operating profit is ahead of expectations (confirmed in a broker note I've seen today), note that operating profit is actually down on last year.

Order book growth is encouraging, although we don't have any information over what period these orders stretch. It could be multi-year stuff, we don't know.

EPS - the accounts state that diluted EPS was 15.0p, however this is including exceptional costs (relating to the IPO). Underlying basic EPS was 19.1p (down from 22.3p last year).

Valuation - at 235p per share, the (now historic) PER is 12.3.

Forecast EPS for 09/2018 is 21.7p

Forecast EPS for 09/2019 is 25.3p

So if those forecasts are achieved, then the PER would be 10.8 and 9.3 - fairly attractive, although contracting businesses don't tend to command high PERs.

Balance sheet - the company has a good cash position, with £27.1m cash, less £8.4m bank borrowings, which nets off to £18.7m net cash.

Overall though, working capital isn't as strong as you might think - the current ratio is 1.27, which is OK, but not particularly strong. I suspect the £49.9m in trade payables probably includes some deferred income - i.e. the opposite side of the double-entry for cash paid up-front by customers.

Overall NAV is £17.0m, less £2.4m goodwill, gives NTAV of £14.6m. I would say that is adequate, but not particularly strong for a company capitalised at £89.5m - therefore this share should be seen as relying on earnings, rather than assets, for its valuation.

Cashflow - a possible concern is that debtors rose significantly in both years. There was a similar increase in creditors in 2016, offsetting this rise. It's something to keep an eye on - I'll be looking to see the £37.8m debtors come down at the next set of interim results. If it doesn't reduce, then that might indicate a problem turning invoices to customers into cash in the bank.

Outlook - sounds positive;

Trading in the first few months of the new financial year has been in line with the Board's expectations. Demand from customers is robust, and the Group's order book continuing to increase with the balance as at 31 December 2017 of 213m, which provides the Board with confidence for the year ahead.

My opinion - I need to do more research on this company, as it was a bit of an impulse purchase a few weeks ago, after several people recommended it to me.

The group seems to operate in a buoyant niche, and with reasonable profit margins. The PER is modest, and it pays an OK dividend. The balance sheet look reasonable. Overall I'd say that I'm mildly positive on it, pending more research. I'd like to see debtors reduce in future, to be sure that profits will turn into cash.

Stockopedia computers like it, with a high StockRank;

Tasty (LON:TAST)

Share price: 30.0p (down 3.2% today at 13:23)

No. shares: 59.8m

Market cap: £17.9m

Trading update - this is a restaurant chain, mostly branded as "Wildwood" - which in my view is a dull, tired, me-too, pizza/pasta format. The Kaye family are behind it, so it's similar to all their other pizza/pasta formats.

Today it updates us for the 52 weeks ended 31 Dec 2017.

This provoked a sharp sell-off this morning, but it has since mostly recovered;

Trading for the period has been in line with expectations.

The Board has previously highlighted the difficult trading environment faced by the restaurant sector and expects a further deterioration in 2018.

This whole sector is indeed suffering badly at the moment. The big issue is over-capacity. There's been a huge increase in the number of restaurants in the last 12 years - up about 30% apparently. So there are too many operators chasing not enough customers. Contrast that with pubs & nightclubs, where many have closed down, meaning that there's now more business to go round fewer players - hence why we're seeing positive updates from pub groups currently, and profit warnings from restaurants.

So it's fairly easy for investors - I'm just avoiding all the restaurants, and instead have made Revolution Bars (LON:RBG) my biggest long position. Hopefully that might pay off, but I'll have to wait and see.

Forecasts for Tasty are for little more than breakeven in 2017, so could 2018 turn into a loss? I cannot see any reason to want to get involved here. I think the next few years are likely to be all about struggling to survive, not creating shareholder value.

Disposals - good news that it has managed to dispose of 4 under-performing sites, with 2 more pending.

FD resignation - announced today, but it sounds harmonious, as he's apparently going to be serving his 3 months notice. A replacement has been lined up.

My opinion - there's nothing here which interests me.

The only restaurant chain I'm interested in buying more of (to add to a tiny scrap I currently hold) is Fulham Shore (LON:FUL) . However, having seen how empty several of its new sites are (taking space from Debenhams), I think FUL could have another profit warning in it. Also I'm a little nervous about its bank debt. So I don't think there is any rush at all to go back into this very difficult sector. There are likely to be many casualties, particularly of independent operators, in my view.

Games Workshop (LON:GAW)

Share price: 2575p (down 2.8% today, at 13:53)

No. shares: 32.3m

Market cap: £831.7m

Interim results - for the 6 months to 26 Nov 2017. This is a retailer of figurines for fantasy gaming.

These numbers can only be described as spectacular! Pre-tax profit for the 6 months is up from £13.8m last time to £38.8m this time. Wow!!!

The reason seems to be that a game called Warhammer has been a big hit. The big issue now is trying to predict how high, and for how long, demand is likely to remain at elevated levels. I haven't got a clue on that, so there's not really a lot more that I can add, other than to congratulate investors who spotted the opportunity here.

At some point profits are likely to go backwards. Do readers have any views on how this might pan out? It's important not to over-pay, by paying a high multiple of peak earnings. That's the main risk here.

I've run out of time now, so just a couple of brief mentions now;

Carr's (LON:CARR) - this share is up 13% today on a trading update which is only in line with expectations. The commentary sounds upbeat though, e.g.

"We are pleased with how FY18 has commenced. We are seeing the continued recovery across both divisions and the investments we have made in acquisitions and research will continue to act as a solid foundation for ongoing growth."

Might be worth a closer look, as the valuation seems fairly modest.

I'm not keen on this share, as it's just traded sideways for the last 4 years. Is there much upside on this type of share, in a bull market that is seeking growth companies?

Bioquell (LON:BQE) - not one I follow, which is a pity, as it's been rising strongly over the last year. A decent update today says that pre-exceptional PBT is expected to be "significantly ahead of market expectations". Very good. It had net cash of £14.5m at the year end.

Majestic Wine (LON:WINE) - this share is flat today, on an OK trading update - "on track to meet full year expectations". The retail division delivered +1.3% LFL sales over the crucial Xmas period. That was against tough prior year comps. Gross margin "broadly flat" against last year.

Personally, I remain to be convinced that the Naked Wines operation is any good, but time will tell. The share has had a terrific run, up about 50% in a few months, so personally I'd be banking the gains if I held, as the forward PER of 22.7 looks racy to me.

4imprint (LON:FOUR) - shares are up 10.4% on a statement that US tax reform will be very beneficial. This was a known factor, so I'm flummoxed as to why the market did not anticipate this. Seems very odd. I wonder if there are other shares where an opportunity exists to buy now, ahead of US earnings shooting up due to tax reform? I see that Somero Enterprises Inc (LON:SOM) (which I hold) has been rising nicely of late, probably due to the same reason.

All done! See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.