Adding your transactions

If you wish to track and analyse the performance of your real Portfolio in Stockopedia you will need to enter the number of shares held and the price paid for each of your real world holdings.

We operate a transaction based portfolio management system allowing the accurate evaluation of your portfolio on a minute by minute basis. The lot based system allows you to track every single purchase and sale for every portfolio holding.

Entering your data

To enter Folio transactions you will need to be on a Folio page, which you can select from in the navigation menu on the left.

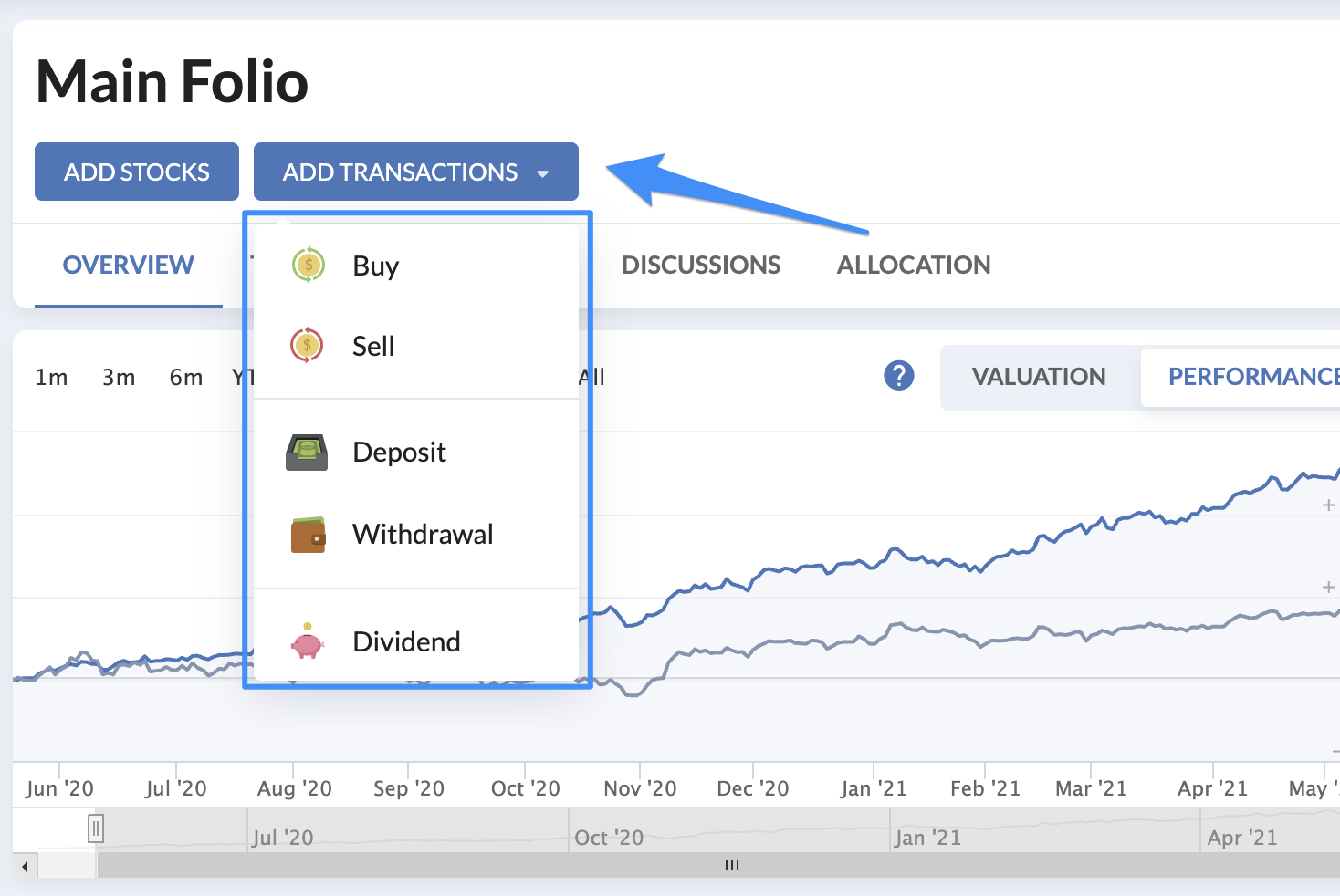

Once on a Folio page, to add a new transaction simply click the Add Transaction button which can be found at the top of the page.

You’ll then see a drop-down menu that will allow you to select which kind of transaction that you wish to enter.

Buying or Selling Shares

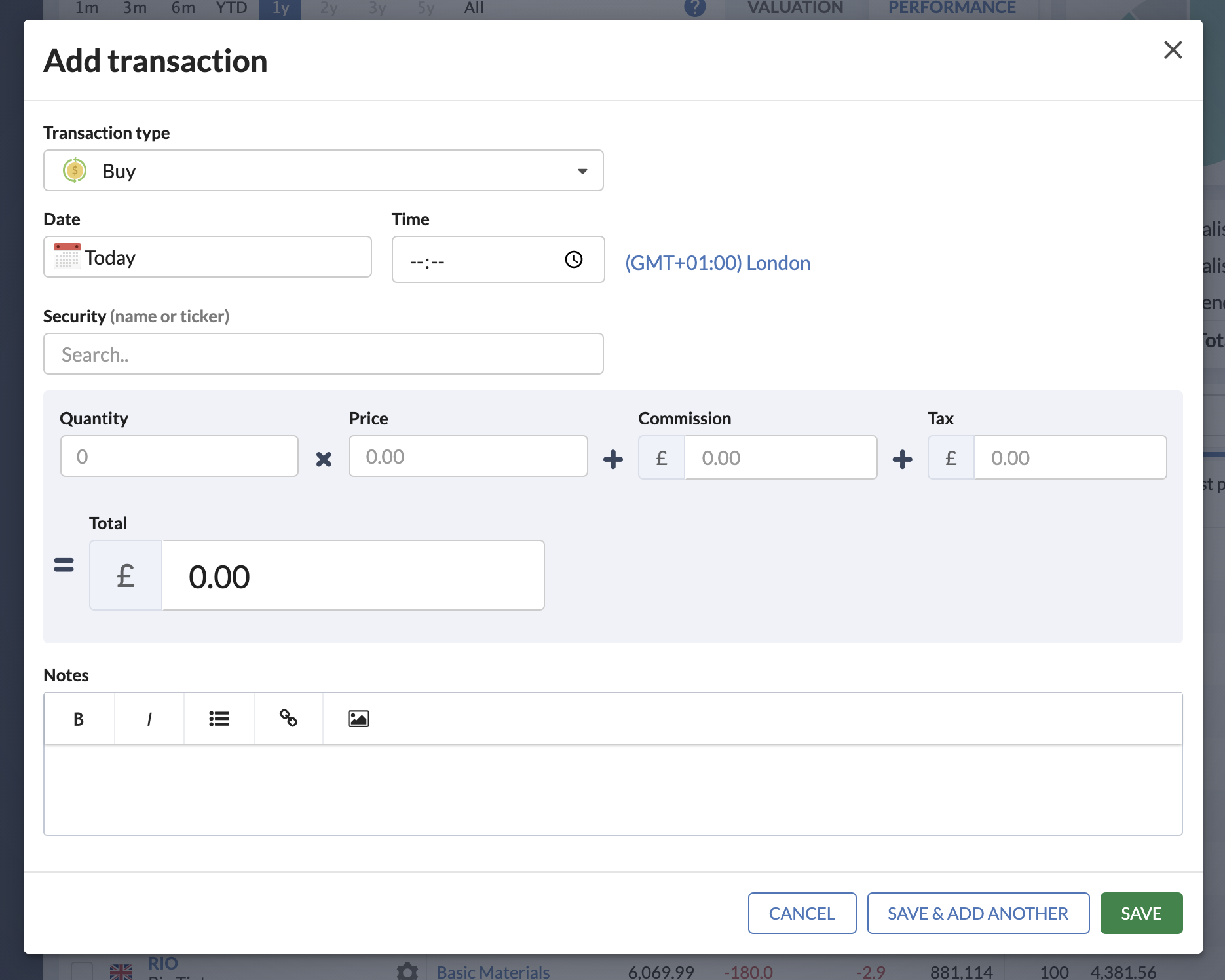

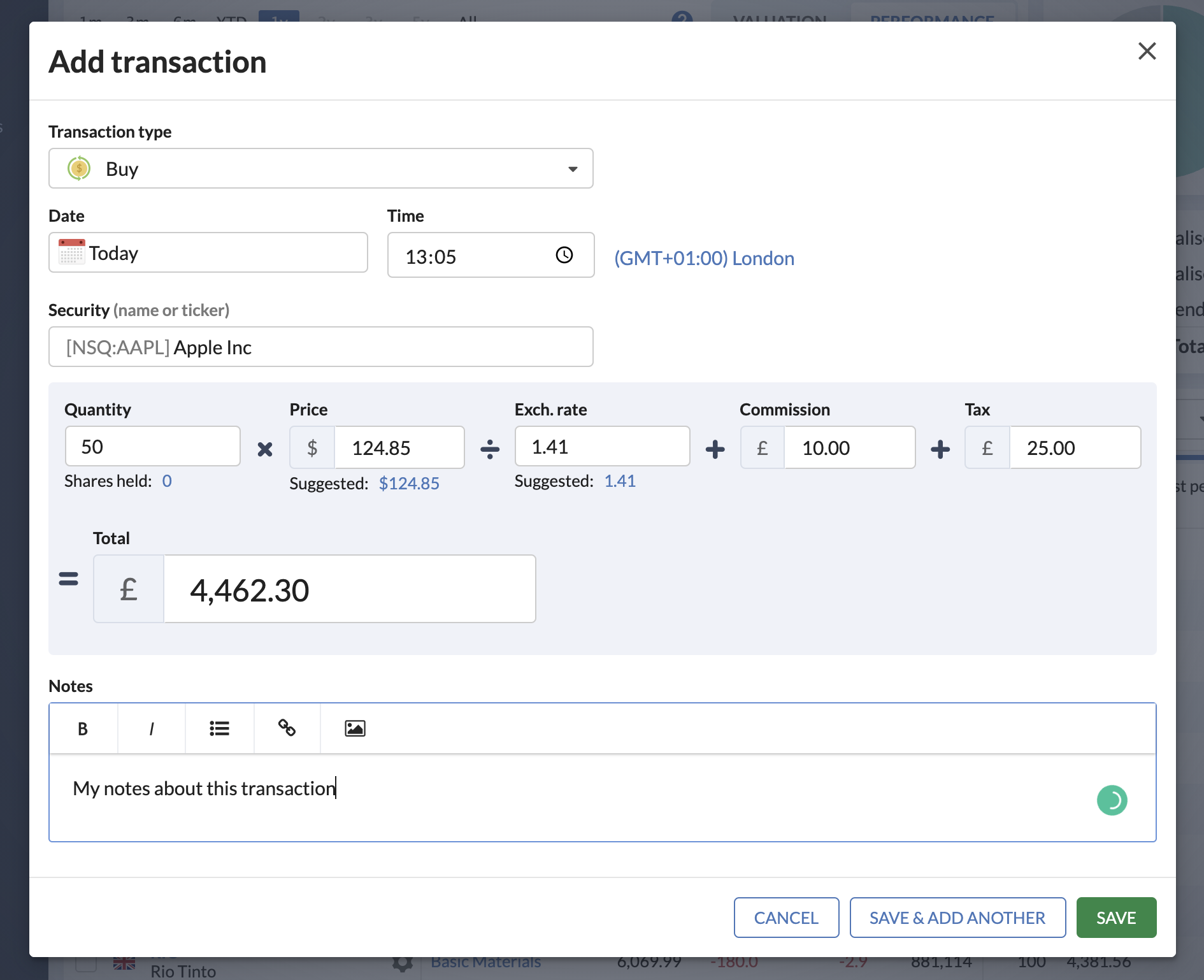

If you choose a Buy or Sell transaction, a modal pop-up entry form will appear in which you can enter the precise details of any share purchase or sale.

The first task is to enter the date of the transaction. You can also add the time that this transaction occurred (as of the timezone shown) for greater accuracy of portfolio accounting, however this field is optional.

Next, you need to enter the name of the security. The input box works just like all of Stockopedia search boxes. Simple enter the ticker or company name and ensure you click (or key down to select) the correct security from the drop-down list.

Upon entering the security, the price will auto populate with a suggested close price as of the date specified. You can change this manually to reflect the precise transaction price that you received.

If you select a security that trades in a different currency to your portfolio currency, an exchange rate will also be auto populated as of the trade date. Again, you can choose to change this manually to reflect the exchange rate received.

Once you enter the quantity of shares purchased or sold, the Total will be auto-calculated. This Total will adjust as you add any further details regarding Commissions and Taxes . You can also simply type in the Total field and number of shares to calculate the price paid.

You can also add notes about the transaction in the Notes box in the pop-up. Some subscribers use these to log actual trade reference ids or their reasons for a purchase or sale.

Finally, either click Save and the transaction will now be logged on the main Transactions page, or Save and Add Another to keep entering more transactions.

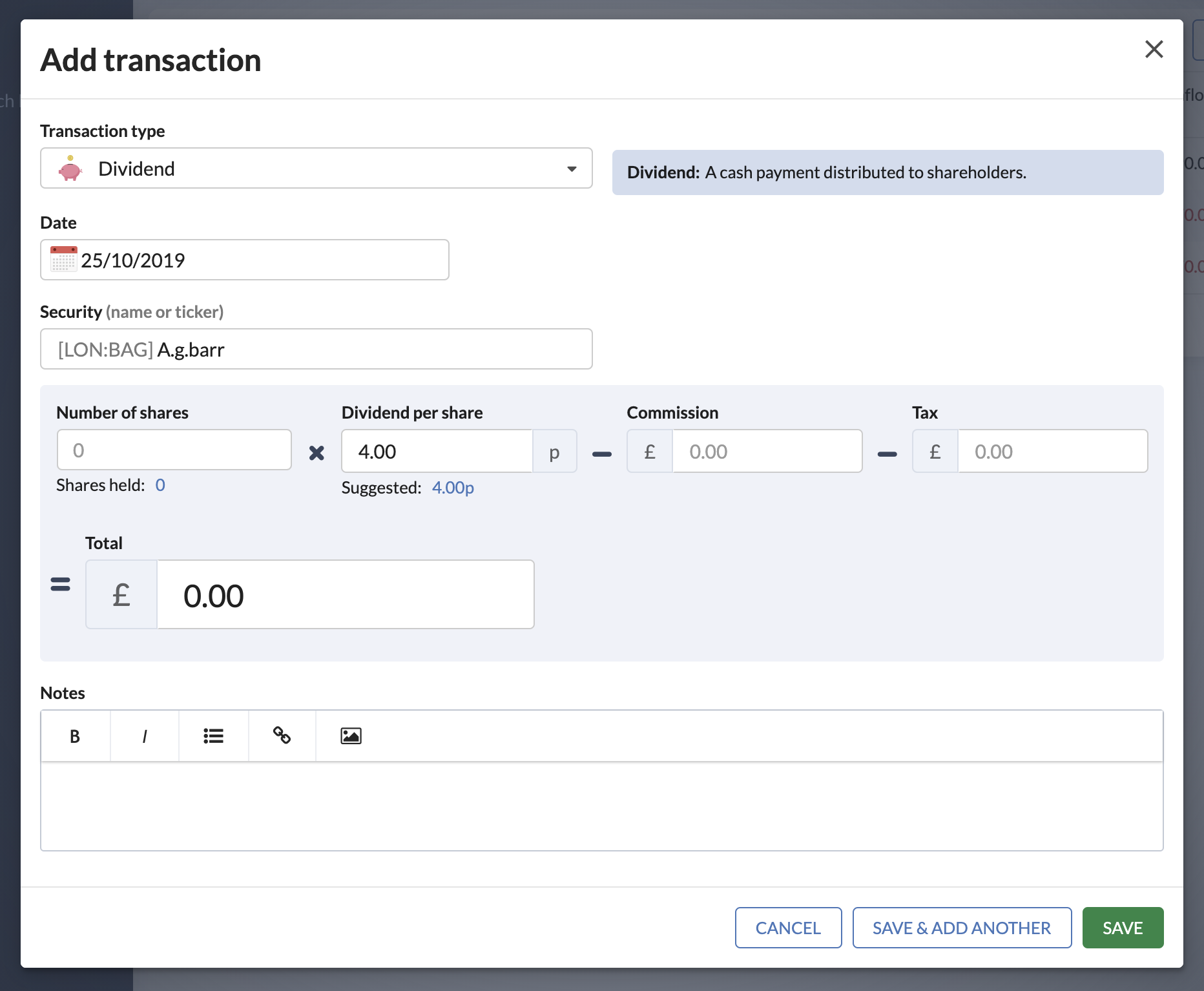

Tracking Dividends

By selecting Dividend as the type from the dropdown in pop-up transaction form, adding the number of shares you hold in the company and the dividend per share field you can save your dividend payment, with the option to add any tax and commissions. Alternatively, as with other transactions above, you can add the total dividend paid and number of shares to calculate dividend per share.

Dividends (while logged with a portfolio position) are treated similarly to a cash deposit to your portfolio.

Adding Deposits & Withdrawals

If you run your own dealing account, have a UK ISA or SIPP you'll always have a cash balance unless you are fully invested. Stockopedia’s Folios give you the ability to log your actual cash deposits and withdrawals to generate a more complete portfolio valuation. All buys and sells will then debit or credit this cash balance.

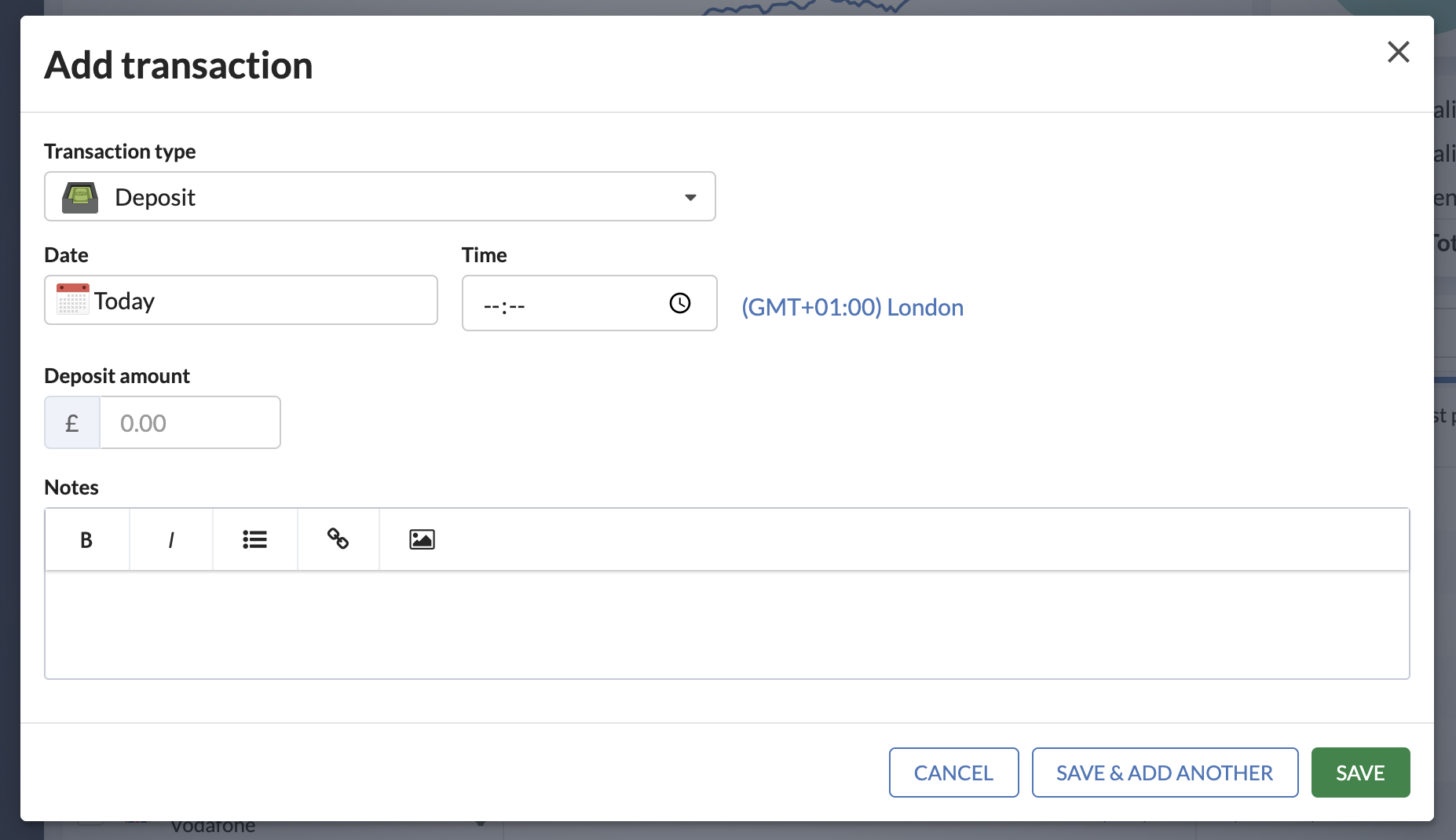

Adding or withdrawing cash from a folio can be managed by clicking the the Add Transaction button and selecting either Deposit or Withdrawal.

Clicking the Date box will open a pop-up calendar, allowing you to select the precise date of the transaction.

Next, add the cash figure and then any notes that you wish to make. Then click save. This will automatically adjust the net cash balance of the folio.

Please note that unless your cash balance is greater than the cost of your positions you may run into an improper valuation. Having a positive cash balance is required to see the performance of your portfolio. After all in the real world brokers rarely let you buy shares for more than the cash in your account! If you wish to add the cash imbalance manually, please refer to the Cash Imbalances section.

Adding bonds and preference shares

Our portfolio system takes the quoted price to be per individual instrument. However, in some cases, bonds (and selected preference shares) are quoted as trading in a block of 100.

A stock will typically trade in pence (i.e minor currency units), denoted by "currency = GBX" on the LSE website. However, many bonds trade in GBP (i.e. major currency units) reflecting a block of 100 bonds. An example of this is Beazley’s BE01 preference share, where the GBP price quoted is per GBP100 nominal of preference shares purchased.

In such cases, to make the valuation work within the portfolio system, you will need to reduce the quantity you hold by a factor of 100.