Good morning!

It's a very quiet day for interesting news today. For newcomers who may not be aware, we normally only cover interesting trading updates & results announcements in these reports.

In response to reader requests, I'll also circle back to yesterday's announcement from Frontier Developments (LON:FDEV) . Searching the archive, I see that Graham has written about it 3 times in the last year. I last looked at it in Sep 2017, and it didn't float my boat then, on valuation grounds mainly. So, once I've got up to speed by reading that lot, and read the accounts, I'll post my latest thoughts here.

Firstly, let's have a quick look at today's trading updates & results in the small caps space.

McBride (LON:MCB)

Share price: 132.5p (up 1.6% today, at 14:30)

No. shares: 182.6m

Market cap: £241.9m

McBride plc, the leading European manufacturer and supplier of Co-manufactured and Private Label products for the Household and Personal Care market, announces its results for the year ended 30 June 2018.

This is another share which has wilted over the spring/summer this year.

Recap - which I might as well type up, as I'm doing the work anyway);

7 Sep 2017: (191p) My review of results y/e 30 Jun 2017. In line results. I disliked: debt & pension-deficit on balance sheet, and H2-weighting comments in outlook section for the new year. It looked decent value though, and had a high StockRank of 95. Seemed a very good turnaround in performance (and share price).

24 Oct 2017 (213p) - I reviewed another trading update, confirming in line with expectations, but again mentioning H2-weighting expected for FY 06/2018. I concluded that it was probably not a bargain, on PER of 14.

We didn't report on it here at the SCVR after that for a while, probably because the company just doesn't interest Graham nor myself. It's desperately dull having to write about companies that you can never see yourself owning. The share price turned south from 8 Jan 2018, falling from a peak of 230p in Dec 2017 to a low of 121p in May 2018.

The chart suggests that the rot set in from 8 Jan 2018, with a lurch down, then establishing a downtrend.

8 Jan 2018 - profit warning, says that cost inflation, margin pressure, and weak trading in one division, means that profits will be "broadly in line with the prior year", instead of growing.so a bit below then. Still saying that new business wins should be positive for H2.

22 Feb 2018 - poor H1 results. Adj operating profit down 31%. No change to full year outlook.

3 Jul 2018 - Graham reported on another profit warning. He's not convinced that the share is yet into value territory, due to heavy debt, and weak performance.

Interestingly, this chart is another good example of where selling on the opening bell after a profit warning would have been the best strategy. That was of course the key message from the brilliant Stockopedia "Profit Warning Survival Guide"

Results today - The above sounds very negative, with the company repeatedly disappointing. So I've been expecting today's results to be dire. Actually, they're nowhere near as bad as I had been warmed up to expect. This is for y/e 06/2018 (continuing operations only);

- Revenues up 9% to £690m (of which only 1.3% is organic growth)

- Adjusted operating profit down 10.2% to £37.7m

- Adjusted profit before taxation down 5.4% to £33.2m

- Adjusted diluted EPS down 4.5% to 12.7p - a PER of 10.4

Hardly a disaster! I'd better check to see if the adjustments look reasonable. Adjustments comprise reversing out amortisation of acquired intangibles of £1.4m, which looks fine, and is not material anyway. Plus £4.8m in exceptional items (see note 4), relating to an acquisition, and re-organisation (closure costs of Hull factory). Overall then, adjustments seem reasonable. Although you could argue that the group is almost constantly reorganising.

Balance sheet - as mentioned above, this has been an area before where I'm not entirely comfortable. Looking at it again today, it's a little thin for a group this size, but overall not too bad.

NAV: £67.6m

NTAV: £37.7m - after deducting goodwill of £20.4m and Other intangibles of £9.5m

Working capital isn't great, with a current ratio of 1.05, and the company relies on bank debt, but I cannot see any reason to think that bank facilities would be under threat.

I've checked the last Annual Report (for 2017), and McBride had £58.6m in land & buildings on the balance sheet, which is usually freeholds. I don't know what the open market value is, but at least the book value of property supports about half the net debt of £114.3m, lowering risk as far as the bank, and investors, are concerned.

Cashflow statement - a few things jump out at me. Firstly, how cash generative the group is - operating cashflow after changes in working capital was £46.0m this year, and £66.3m last year.

The pension deficit consumed £3m in recovery payments each year. The deficit shown on the balance sheet has come down from £42.2m to £30.9m. Progress, but it's still a drain on cashflow.

Interest costs reduced considerably this year, after a refinancing, which is good.

Capex is high though, as this is a capital-intensive business, and has risen to £22.4m (up from £15.2m last year). Unfortunately, this consumes most of the post-tax cashflow, leaving little free cashflow this year, well down on last year. I make free cashflow 2.6p this year, versus 10.7p last year. That's a concern. A mature business like this should be throwing off buckets of free cashflow, but it's not.

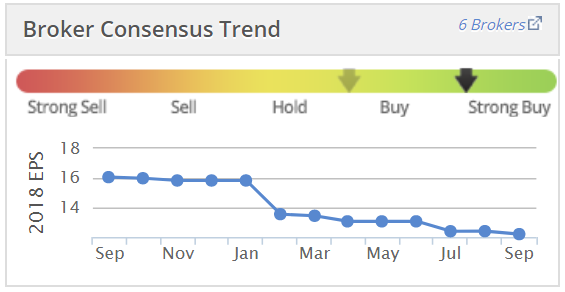

Outlook - I was tempted to say that we can't rely on management assurances here, given the consistently too optimistic outlook comments over the last year. Whilst results today may have looked quite reasonable, remember that the forecasts were steadily revised down.

As you can see from the Stockopedia broker consensus chart below, the 12.7p delivered today is well short of the c.16p that forecast this time last year;

I sympathise with management though. Running a group like this must be a nightmare - lots of moving parts, and so many things that could give unpleasant surprises. Plus ruthless customers (supermarkets) constantly trying to squeeze every drop of profit out of their supply chains. The capex planning must take years, to build and fit-out factories. Then anything could change to render those decisions problematic. Yet what's the alternative? If production was outsourced, it would probably cost a lot more, hence profit would disappear.

Anyway, this is what the company says today on outlook;

In the current year we remain focused on the profitable delivery of our anticipated volume growth whilst continuing to take actions to mitigate strong input cost inflation, including commercial price recovery from our customers.

We will also maintain close control of overheads whilst investing in key focus areas that will enable McBride to fully exploit its scale and cost advantage within its supply chain.

Revenues in the first few months of the new financial year have been satisfactory and whilst certain cost pressures persist, at this stage the Board remains confident the Group will achieve its full year expectations.

I view that rather sceptically. The words "at this stage" always ring alarm bells to me. I read that as saying that the risk of disappointment is quite high. Therefore I am minded to take forecasts with a pinch of salt.

Dividends - this looks a bit odd. The company seems to use a convoluted way of distributing dividends. I think we discussed it once before, but I won't do any digging on this, as time has run out today.

In line with the policy on payments to shareholders, the Group expects to distribute adjusted earnings to shareholders based on a dividend cover range of 2x-3x progressive with earnings of the Group, taking into account funding availability.

Following the interim payment of 1.5 pence declared in February 2018, the Board recommends a final payment of 2.8 pence (2017: 2.9p) to shareholders such that the full year payment remains unchanged at 4.3 pence (2017: 4.3p). It is intended this will be issued using the Company's B Share scheme.

That looks to be a yield of 3.2%. Although the "taking into account funding availability" doesn't instil much confidence that the divis are safe!

My opinion - I'm reasonably OK with the balance sheet overall, although there is considerable debt.

Free cashflow is weak, so that's a concern.

Rather than expecting an EPS increase from 12.7p last year, to 14.6p this year (current consensus forecast), I'd be happier working on a range of say 8p to 15p, being my guess of worst to best case scenario. In reality, I have no way of knowing what the outcome is likely to be, it's pure guesswork.

McBride has been restructuring for several years now. At first that seemed to go well, but performance has been less impressive (but far from bad) in the last year. It seems to me that, if management can get the restructuring working again, then the shares could have another run up.

In normal market conditions, I would be tempted to have a little nibble here, opening a small long position. However, with so much macro uncertainty around right now, I'm not interested in taking on new positions unless they're a complete no-brainer. Whereas this one could go either way, in my view.

Generally, I try to avoid suppliers to supermarkets, as they struggle to eke out a living given how cost-conscious the supermarkets are (and have to be, given their own wafer thin operating margins).

So McBride looks potentially interesting, but it's not for me at this point in time.

Best Of The Best (LON:BOTB)

Share price: 260p (up 2% today, at 10:36)

No. shares: 10.1m

Market cap: £26.3m

(at the time of writing, I hold a long position in this share)

AGM Statement (trading update)

This share is very illiquid, due to being tightly held, mainly by management.

BOTB organises weekly competitions to win supercars, and more recently "lifestyle" prizes such as fancy watches, consumer electronics, motorbikes, etc.

Airports - this is traditionally what built widespread public awareness of the company. However, these have become uneconomic, and a hassle to manage. So the company is transitioning to online only. It now just has 1 physical site left, at Birmingham Airport. The declining revenues from physical sites has masked its online growth, which is a potential opportunity for investors.

Current trading - this is for year to date, FY ending 30 Apr 2019, so we're about a third of the way through this FY;

The Group is pleased to report that the positive momentum to the start of the year, reported at the time of the full year results, has been maintained and the Company has continued to make good progress and is trading in line with market expectations for the current financial year.

FinnCap (house broker) notes are available on Research Tree, so I can quantify things easily. We're looking at forecast adjusted EPS of 11.8p. Therefore the PER is 22 times.

Online growth businesses don't lend themselves particularly well to the PER as a valuation measure (which is more appropriate for mature businesses). The reason being that marketing spend is usually the biggest variable cost. That's great because it can be dialled up or down to whatever level management want. Therefore profit could be seen as little more than a policy decision by management.

There's a trade-off between spending more on marketing to generate growth, but lower short-term profits. Or, run the business lean on marketing spend, to generate profits & cash, but see slower growth. The latter seems to be the route favoured by BOTB management in recent years.

I sometimes get frustrated that a business with such great potential isn't growing faster. On the other hand, I have been a grateful recipient of some terrific dividends & special divis in recent years, some of which I have recycled back to the company, playing its surprisingly fun spot-the-ball game online (usually when I get home from the pub!)

The game is cleverly designed so that you almost always get close to where the ball is deemed to be by the expert judges, hence win some of your money back. That keeps you playing.

I interviewed the personable CEO here in Jan 2016, a lot of which is still relevant. I must ask him back for an update interview when the next results come out.

My opinion - a reassuring update today. Based on current growth, I think that at the moment, the valuation looks about right.

It's the upside potential that is more exciting. If the growth rate accelerates, now that management is freed up to concentrate on the online operation only, then the share could re-rate upwards. Being online only can only help in that regard, in terms of market perception.

Maybe management caution, in keeping marketing spend moderate, in order to maintain profits, has allowed them to learn which digital marketing strategies work best, and therefore avoid wasting money with a more profligate approach might have entailed.

I am hoping that a more turbocharged marketing approach, once effectiveness is proven, could at some point transform the scale of this business. It's a global competition remember, not just UK, so BOTB is really only scratching the surface of the potential market.

Overall then, I'm happy to hold for the foreseeable future, and am fairly confident that, at some point my patience should be rewarded - with either faster growth & a re-rating, and/or eventually a trade sale at a premium. There's obvious upside from a bigger gambling company buying BOTB, and then pushing millions of existing customers towards BOTB. Each new customer is almost pure profit, so the commercial logic is very strong.

This share is not for traders, or the impatient!

Frontier Developments (LON:FDEV)

Share price: 915p (up 3% today)

No. shares: 38.7m

Market cap: £354.1m

Frontier Developments plc (AIM: FDEV, 'Frontier', the 'Group' or the 'Company'), a leading developer and publisher of video games based in Cambridge, UK, has published its full year results for the 12 months to 31 May 2018 ('FY18').

These results came out yesterday.

To recap on our previous commentary on the company here, and to get me up-to-speed, here's a review of our previous reviews!

Almost exactly a year ago, I looked at this company, reviewing the year's results, I was impressed by profit growth, but concerned that 76% of EBITDA was spent on capitalised development costs. Hence the operating cashflow of £3.4m looked very poor for the then market cap of £464m. I didn't make a judgement on the business model, but just looked at the numbers.

Graham chipped in with some interesting comments, and a comparison with a US games company, the next day, here on 8 Sep 2017.

Graham wrote about a trading update here on 12 June 2018. He focused on what seems to be the main reason for this share being so expensive - hopes for its new game launch due in summer 2018, called Jurassic World Evolution. Revenue & profit expectations were increased, but still at very low levels considering the huge market cap.

Graham reported here on 3 Jul 2018, on another positive trading update - upgrading expectations again, for the current year (ending 31 May 2019). It's becoming clear to me that investors have very high expectations for future growth in revenues and profit, hence why the share is so richly valued (on historic numbers). Graham also pointed out the huge operational gearing if games publishers hit the jackpot with a successful game, as the gross margin is so high, at over 70%.

That was really useful in improving my understanding of things to date. Remember that Stockopedia members can easily search our archive for previous comments on any company, just by clicking on the "Discuss" tab near the top of any company's StockReport. I don't know if that is available to non-subscribers or not, I imagine not, as obviously this website wouldn't exist without paying subscribers, so they have to charge for something!

I see that the share price has almost halved from its peak in June. To be fair, lots of highly rated growth companies have had similar sell-offs this summer. There are a lot of punters following momentum-based strategies, and using stop-losses right now. This exacerbates volatility. It has probably also stretched valuations more than usual on the upside (since many buyers didn't care about valuation, as long as the price kept going up).

The problem comes when all those people using the same momentum strategy decide to sell - they're all trying to sell at the same time, creating big moves downwards from the peak. I'm seeing a lot of this at the moment, with loads of shares. Selectively, it's creating some nice buying opportunities. We have to be so careful though, not to catch falling knives, where the share price fall is happening for a good reason (which may not always be apparent until later).

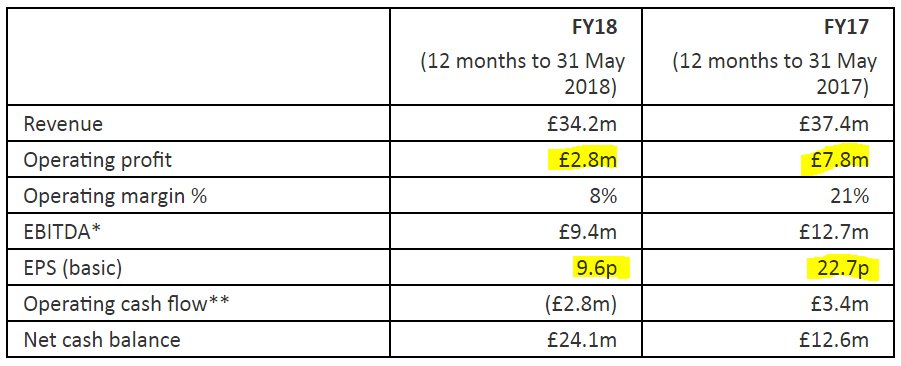

Latest results - the financial highlights look awful, with a big plunge in profit. However, this was as expected, actually it looks better than expected - the update on 12 June 2018 indicated operating profit would be c.£2m. Therefore £2.8m looks a beat. It's still a huge fall from last year, so I'm struggling to see this beat against forecasts in a positive way.

The company says that the fall in profit was due to;

... no new franchise launch in FY18 and our planned increased investment in development and marketing saw operating profit reduce to £2.8 million (FY17: £7.8 million) and EBITDA reduce to £9.4 million (FY17: £12.7 million).

Remember this company is valued at £354m, so these numbers only justify a small fraction of that valuation. The value is obviously more in future expectations, so let's move on to that.

Current trading & outlook - the company makes positive noises about its latest big games release;

The launch of Jurassic World Evolution in June 2018 has led a record trading performance during the period from the year end (31 May 2018).

Digital sales of Jurassic World Evolution have been substantial across all three platforms, (PC, PlayStation 4 and Xbox One) and physical disc sales on PlayStation 4 and Xbox One have also been significant.

On 19 July 2018 Frontier announced that cumulative sales on all formats had passed 1 million units, just 5 weeks after the digital launch on 12 June 2018.

I don't know what level of sales was expected, so cannot assess this unless I manage to find some broker coverage.

More specific guidance is given, which is very helpful;

Although it is still early in terms of both Frontier's financial year and the life-cycle ofJurassic World Evolution, the Board is comfortable with the current range of analyst revenue projections of £75 million to £88 million for FY19 (the year ending 31 May 2019), a substantial increase over the £34 million achieved in FY18.

Directorspeak - self-explanatory;

"Jurassic World Evolution has achieved our biggest launch to date, and we are now very well positioned with three successful revenue generating franchises. We will continue to support and enhance all three of our existing franchises (Elite Dangerous, Planet Coaster and Jurassic World Evolution), and we'll be making a number of exciting announcements about each franchise in due course.

Franchise four, which is based on our own un-announced IP, is now in full development and targeted for release in FY20, and two more new franchises are in earlier stages of development."

I'm starting to understand why this share appeals to some investors here. The company seems to be establishing a good track record at creating games franchises. They're called franchises because a series of new versions are subsequently released, hence games companies can generate multi-year profits from constantly putting out newer versions of popular games.

Valuation - the historic numbers are not really of much relevance, so I think it would be a mistake to over-analyse them. This is often the case with growth companies. People complain that they're ridiculously expensive on historic numbers, but investors are buying the future, not the past. That's completely different to conventional value investing. The big problem with growth company investing, is that we don't know what the future holds, and it can turn out radically better or worse than expected. So high valuations are extremely dangerous if anything goes wrong. Whereas repeated upside surprises can fuel multi-baggers.

Forecasts - there's an excellent update note available on Research Tree (thank goodness we have RT, as without it, post the disastrous MiFID II, we would be almost completely in the dark). I hope people are writing to your MPs, to express your disgust at MiFID II shutting down PI access to a lot of research.

FY 05/2019 is now forecast for a huge jump in EPS from 12p to 43p. There's a difference between the broker's FY18 EPS figure of 12p, to the company's (in the table above) of 9.6p. So it looks like the broker is making some adjustments. Generally I find that most adjustments are reasonable, but I usually check to be sure, before making a purchase.

Assuming that the 43p forecast is achieved, then at 915p per share, the current year PER is 21.3 - which looks fairly reasonable for a growth company.

The only trouble is that computer games have a huge surge initially, and then tail off quite quickly, in sales and profits (until a new version comes out, if the franchise is successful). So my worry is that we could be valuing the shares on peak year earnings, and thereby over-valuing the company?

Forecast EPS for FY20 actually drops quite sharply to 26p, then back up again to 48p in FY21. That makes me nervous. I wouldn't want to be holding the share when investor attention switches from the bumper profits year, to the quieter following year.

My opinion - I've seen enough to feel that it's not for me, as I don't have enough knowledge of this sector to make the accurate estimates which are vital in valuing the shares. Also, I'm really not looking to buy any new positions at the moment, due to uncertain macro conditions, unless I find something absolutely exceptional and/or dirt-cheap.

I can understand why bulls like this stock - it's all about buying into what looks like a talented team, building a track record of creating successful games franchises. This could work out very well long-term, if they continue to execute well.

It's likely to be a bumpy ride though, as valuation is so tricky, and dependent on large, lumpy projects where the costs are all up-front, then sales are difficult to predict. Any company creating a blockbuster franchise could do very well indeed for shareholders. So that's obviously what bulls here are betting on. It might also become a bid target for a larger player?

Given that the share price has almost halved in recent months, then this is probably as good a time as any to get involved, if you missed the original huge bull run. I haven't seen anything in this results announcement to justify the big price drop yesterday.

Could be an interesting punt for the brave and sector-knowledgeable investor?

Right, that's all I can manage for today.

See you in the morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.