Good morning!

MBL (LON:MUBL)

- Share price: 3.7p (-18%)

- No. of shares: 17 million

- Market cap: £640k

Cancellation of Admission & Notice of GM

I mention this out of morbid curiosity rather than any interest in investing in it

The directors have taken the opportunity to write up a more complete explanation around why they seek to delist.

It is very carefully worded. There have clearly been a lot of tensions between various parties associated with the company, and this has been going on for a long time.

The bottom line financially is as follows: MBL had cash of £800k at the end of July, and expects to receive another £375k from a disposal. Out of these funds, it needs to pay the £75k fine to the FCA and running costs until it liquidates.

We also have this grenade of a sentence:

Shortly before issuing this Circular, the Company received notice of a claim in relation to a historic matter which is potentially material. The Company is taking legal advice about the merits of the claim and will update Shareholders, as appropriate, in due course.

The saga of disagreements and disputes rolls on and on.

The directors have had enough:

The Company has little opportunity to make a return to Shareholders should it continue to face the costs such as those arising from further requests for investigations, litigious behaviour and the associated additional costs involved in investigating and defending these claims whilst maintaining its public company status

MBL is heading for an ignominious end to public life. It turns out that the market wasn't unduly bearish on it for all these years. If anything, it wasn't bearish enough!

Boxhill Technologies (LON:BOX) (suspended)

Update on Annual Report and Accounts - another share I'm mentioning so that we can file it in the "what can go wrong" or "this is how shares die" category.

This has been unable to publish accounts for the year ending January 2018.

Apparently the year-end bank balances of a former subsidiary can't be accessed, because a director of that company was dismissed and (s)he was the sole authorised signatory. The process to fix this is estimated to take around 3 months.

It's the sort of thing you might expect from an AIM-listed Chinese share.

Lookers (LON:LOOK)

- Share price: 105.7p (+1%)

- No. of shares: 394 million

- Market cap: £417 million

We are now looking at a "proper" company.

This is a motor retailer and aftersales group. My mind is still fresh with the memory of writing about Marshall Motor Holdings (LON:MMH) yesterday. And I was also studying Pendragon (LON:PDG) not that long ago. All in the same sector.

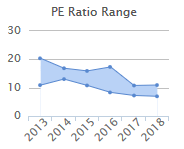

While car retailers in general are very cheap these days in terms of the earnings multiple, it wasn't always the case.

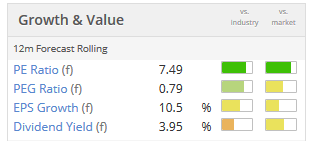

Lookers' P/E ratio has been trending lower:

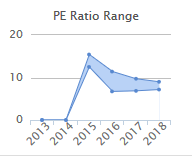

The same is also true to an extent of Marshall Motor (it only listed in 2015, so incomplete data):

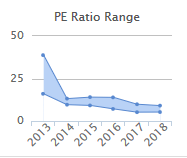

and Pendragon:

So it is possible for car retailers to have better ratings than they currently do.

But they don't have much earnings momentum at present and macro trends for new car sales are pointing downwards, so the outlook is understandably bearish.

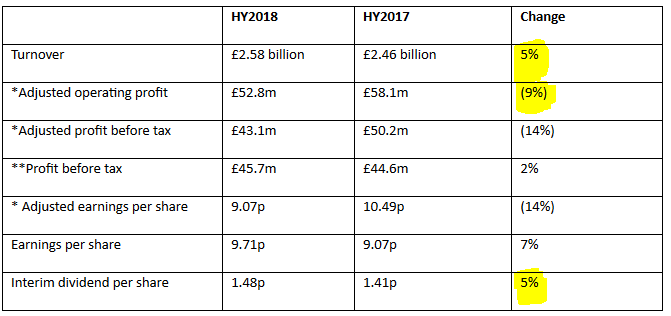

That's the context for these results:

- New car turnover is described as stable.

- Used car turnover increases 12%, although gross profit rises by a much smaller amount.

- Aftersales turnover up by 6% - excellent.

All of this sounds ok. Not stunning, but nobody is expecting stunning results from these companies.

Lookers is on course to meet expectations for the full year.

Zeus Capital are forecasting EPS for the current year of 13.1p (that's fully diluted & adjusted EPS), according to a note published on Research Tree. They have increased this estimate from 12.4p.

Higher Expenses

There is a divergence between the growth in revenue (5%) and gross profit (3%) versus a decline in adjusted operating profit (-9%).

There were cost increases, "particularly salary costs due to cost of living increases, increases in the minimum wage, auto enrolment pension costs as well as higher rent, rates and utility costs across our property estate."

I don't think we can count on any of these factors dropping back. We should assume these are permanent changes (and could be made worse again in future periods).

I also see that interest costs are on the increase, and are material at £9.7 million. Easy to forget that in a rate tightening cycle, it's not just customers who might feel the pinch. The car retailers themselves will be paying higher interest, too.

Dividends & Buybacks

Cash flow generation remains strong, so shareholders enjoy a 5% hike in the interim dividend, and the buyback programme continues.

Pendragon (LON:PDG) is buying back shares too. The dealerships clearly have a belief that their shares are undervalued (most companies believe their shares are undervalued, but it's the action of buying back their own shares that proves it!).

Outlook

There are an "encouraging" level of new car orders, increased market share of used car sales and opportunities to further improve the aftersales business.

Against that, there is the political/economic/exchange rate uncertainty faced by all car retailers.

The balance sheet looks ok to me, with tangible equity of nearly £200 million.

As I said regarding Marshall Motor Holdings (LON:MMH) yesterday, I'm looking for companies which offer a unique reason to invest, and I can't distinguish between these car dealers. So it's not for me.

If you like value, there is plenty of that to eat here. Stocko algorithms aren't seeing a huge amount of Quality or Momentum, however, and I can only agree!

Minds Machines (LON:MMX)

- Share price: 8.45p (unch.)

- No. of shares: 797 million

- Market cap: £67 million

.WORK Most investment supported new gTLD in 2018

I was going to say that the RNS was overly promotional, but on second thoughts I can see why Minds + Machines would be pleased about this and would want to announce it.

As the owner and operator of the ".work" top-level-domain (TLD), it's encouraging to see a huge amount of money flow into companies using this TLD.

What this means is that its end-customers are sparking a lot of interest.

Indirectly, that could mean that more money will be flowing towards Minds + Machines in future. It depends on the future demand for websites with the alternative endings it provides. This announcement is a good omen, that's all.

Despite my original suspicions that this was just a "story" stock, I do have a favourable view on the company's plans. Alternative TLDs are becoming more and more popular, and I think this will be a permanent trend on the internet landscape.

Future cash generation will hopefully be predictable and in the company's own words, "annuity based", as successful websites using these TLDs automatically pay their registrar fees every year.

I haven't managed to work out if the market cap makes sense yet. If the forecasts can be believed, for adjusted EPS of 0.5p in 2019, and with a positive long-term trend, it could be at a reasonable price to buy now.

Today's announcement was published via RNS Reach, i.e. it's not considered price-sensitive information.

FTSE 100 Index (UKX)

The FTSE is down by 100 points today. Let's review where we are with this index.

It is still within the range for 2018, year-to-date.

March was a nice short-term buying opportunity, in hindsight. At the time, people were greatly concerned over trade wars between the Trump administration and Chinese steel and aluminium.

Swinging Markets

It's easy to forget how dramatic some of the short-term swings were earlier this year. In February, the Dow saw its biggest ever one-day drop (not in percentage terms, but in points lost).

The accepted reason for that plunge was rising hourly earnings in the US leading to a greater conviction that the Federal Reserve would hike rates multiple times during 2018, to stave off inflation.

The effective federal funds rate between US banks is at 1.91% and is in a clear uptrend with more rate hikes due in the second half of this year. So I don't believe expectations have changed in that regard.

The US 10-Year Treasury yield is currently 2.9%, not far off the high of 3.1% it reached in May. This gives risk-averse investors the opportunity to earn a half-decent yield without buying any shares.

If it got to 4%, we could see a major repositioning out of equities and into bonds.

And the prospect of trade wars hasn't gone away either. Major tariff increases applied to Turkey in the last few days show that this is still a serious threat.

So I don't believe any of the concerns which allegedly produced the sell-offs at the start of the year have gone away.

FTSE Metrics

Let's consider the FTSE again.

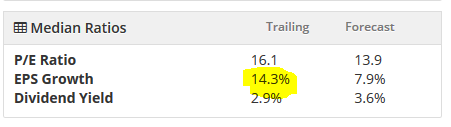

The median ratios attached to FTSE-100 stocks are about the same as they were when I presented them in March, except for EPS growth.

Trailing EPS growth was 20.8% in March, and is now just 14.3%. Is this some kind of statistical anomaly, I wonder?

Forecast EPS growth has fallen too, from 8.4% to 7.9%:

P/E ratios and dividend yields are about the same.

The metric I care about the most is the dividend yield, since dividends don't change very much in comparison to earnings and EPS growth. In a recession, you should find that aggregate earnings fall much harder than aggregate dividends fall. So dividends are a much more dependable basis on which to invest in an index, in my view.

I've managed to find some FTSE-100 dividend yield statistics. This yield reached a high of over 6% back in 2008 (when we all should have been buying shares), before falling to a low of 2.9% in 2011.

The forecast yield available now is not bad value. It's higher than the yield from 2010-2014 (i.e. better value), and about average for the range from 2015-2018.

You might separately form a view as to whether the dividends on offer right now are sustainable or not. There are big yields at Royal Dutch Shell (LON:RDSB), HSBC Holdings (LON:HSBA), BP (LON:BP.) and BHP Billiton (LON:BLT). Perhaps they are riskier payments than they were before?

Overall, the FTSE looks reasonable value to me at present (latest index value: 7530).

What I'm Doing

I still have about 20% that's not in equities. However, I managed to find some animal spirits and invested this into junk bond funds, rather than hoarding cash.

These funds are well-diversified and are short duration, so I expect them to snap back quickly from any drawdown.

It would of course be much better to invest in junk bonds in a high interest rate environment, but it's the same for every asset class. Equities would be much cheaper in a high interest rate environment, too.

These bonds happen to be USD-denominated, which diversifies my currency exposure nicely. And because the short end of the US curve has risen so much, the yield is pretty good compared to any other short-duration investment I could make.

I bought heavily in late June, and so far have nice gains from these purchases thanks to the combination of an increase in the value of the bonds in USD terms, and a strengthening Dollar.

That's pure luck, by the way - I'm not trying to time any moves in GBPUSD. However, it is a very nice feeling to be diversified and not totally reliant on a strong GBP for my purchasing power.

So while these junk bonds are motoring along and hopefully getting a return which is not that much worse than the stock market, am I forgetting about the FTSE? Definitely not! I'd love to switch these funds into equities, if equities were at a nice cheap level.

The way I'm expressing this view is by selling FTSE put options. I started doing it last week, and intend to increase my collection of short puts over time. It gives me a bit of additional income, and I stand ready to switch out of bonds and into the FTSE, if it falls all the way to my strike prices. This could end up being a permanent feature of my portfolio.

I wouldn't recommend that anybody else do this, unless you are really sure you know what you're doing! Even for somebody like myself with experience buying and selling options for my former employer, selling options is not something that I undertake lightly. It brings with it a serious risk of loss.

The other 80% of my portfolio is still in equities, which I'm comfortable with. The UK market doesn't look overly extended to me, and I will hopefully be a buyer of equities in the event that there is a serious correction, or even a crash!

All done for today. Thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.