Good morning!

Today I am looking at:

- Tandem (LON:TND)

- SRT Marine Systems (LON:SRT)

- Norcros (LON:NXR)

- Warpaint London (LON:W7L)

- Altitude (LON:ALT)

Tandem (LON:TND)

- Share price: 177.25p (+4.3%)

- No. of shares: 5 million

- Market cap: £9 million

(Please note that at the time of publication, I have a long position in TND.)

I swore that I'd never touch this share again, and have been an outspoken critic of management at this company - they are paid far too much relative to the size of the business and relative to shareholder rewards, and they spent a lot of money on acquisitions which simply didn't work out very well.

See my comments in September, describing the entrenched board of directors. See my pained description of the company's positives and negatives in July.

In a presentation at the Manchestor Investor Show last year, I laid out in detail the unpleasant metrics: director pay being 33% of operating profit and four times larger than the dividend.

Despite all of the above, I couldn't resist buying a few shares in it today.

It's a trade designed to minimise pain: I wouldn't be able to stomach losing a lot of money twice on this share, but I think it would be even more painful to watch it rally to a decent earnings multiple. So now I'm back with a small stake.

So why am I back in?

Well, it looks as if the company just had an extraordinary H2. There have been false dawns before, of course. So I'm not going to assume that things are going to be rosy from now on.

About the company

Tandem is a designer, developer, distributor and retailer of sports, leisure and mobility products. It has a freehold property at its heaquarters in Castle Bromwich (Birmingham) and rents other premises.

It was already back on my radar as my friend Professor Glen Arnold has been blogging about it in recent days at the Deep Value Newsletter on ADVDN. He reckons there is value in it at the current level, and I agree, but with some heavy qualifications!

It used to be focused on bikes but is now a much more diverse group with a range of toys and garden products.

There is a contract with Walt Disney and Tandem reports today that it has signed an agreeement with Disney "to extend our portfolio of licences for 2019 and beyond".

This will significantly expand our range to incorporate their major properties, including Disney and Marvel and will encompass highly successful entertainment and consumer product franchises such as Frozen, Toy Story, Spider-Man, Lion King, Disney Princess and Avengers.

Perhaps you could argue that it deserves a rating like Character (LON:CCT) has, i.e. 10-11x forward earnings.

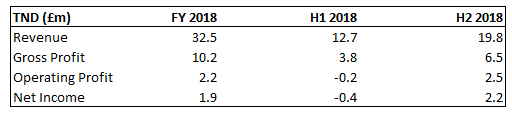

FY 2018: It's all about H2

Tandem was hurt by the collapse of Toys'R Us in February 2018, as it was a major customer. There was chaos in the toy industry around that time.

Because of this, I am willing to forget about the result in H1 2018.

And if we strip out H1 2018 from the full-year results, we get some terrific numbers for H2:

It looks to me that Tandem generated net income of £2.2 million in six months. Not bad for a company with a market cap of c. £10 million.

H1 has been profitable in prior periods, e.g. net income of £0.4 million in 2017. Results are complicated by the effects of currency hedging and adjustments to the pension fund.

Outlook

An unusually bullish statement.

The year has started very strongly for the Group, principally driven by the MV Sports & Leisure business where the forward order book is considerably ahead of the same time last year.

Whilst we are mindful of macro-economic uncertainties, we expect to achieve significant turnover growth and we continue to be extremely confident in our ability to deliver profitability to our shareholders.

Balance Sheet

This has been greatly improved by the positive results in the last couple of years. My own analysis of the balance sheet suggests that there is tangible value of c. £6.4 million (including the value of deferred taxes, but excluding goodwill). That's 127p per share.

The balance sheet includes the freehold property in Birmingham valued at £3.2 million and a small net cash position - the first time the company has enjoyed a net cash position in several years.

The pension scheme deficit liability is measured at £2.8 million and is perhaps bigger than that in terms of its economic reality but looks manageable. The obligation is c. £10 million and the assets are c. £7 million, judging by the figures in last year's annual report.

My view

As stated at the top, I couldn't resist the urge to buy a few of these today. I almost expect to get bitten by another false dawn, but I'd rather be in it than out of it, given the numbers presented this morning. I will be voting against the existing remuneration policy and urging fellow shareholders to do the same.

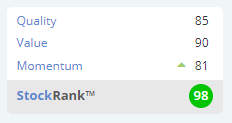

Even before taking today's numbers into account, Tandem was considered to be a Super Stock by Stockopedia, with a StockRank of 98.

If the company could generate even a small profit (say £400k) in H1, and if H2 2019 could be a repeat of H2 2018, then total profits would wind up at £2.6 million for EPS of about 50p.

And if the stock market then decided that it deserved a rating similar to Character (LON:CCT), then the shares would be due for a significant uplift. Let's see! My expectations are extremely low, so hopefully I can enjoy a positive surprise!

SRT Marine Systems (LON:SRT)

- Share price: 34.25p (+13%)

- No. of shares: 153 million

- Market cap: £53 million

SRT is "a global provider of maritime surveillance, monitoring and management systems".

Paul and I have commented before on its lack of visibility and failure to deliver over the years.

As MrContrarian says in his tweet today, there may finally be some jam:

The Company expects to report revenues of approximately £20.0 million and profit before tax of £3.0 million with gross cash as at 31 March 2019 of £3.9 million*.

I haven't got any worthwhile insights into this company but will be very happy for shareholders if it manages to come good.

Norcros (LON:NXR)

- Share price: 190.25p (+1%)

- No. of shares: 80 million

- Market cap: £153 million

This is "a market leading supplier of high quality and innovative bathroom and kitchen products". See my analysis in January for some of the pros and cons. It is active in the UK and South Africa.

Underlying operating profit is expected to be in line with expectations.

Like-for-like revenue growth at constant currencies remains modest at 2.4%, though total revenue growth is over 10% due to a UK acquisition (Merlyn).

Net debt is significantly improved, reducing to £36 million.

CEO comment:

Our performance continues to demonstrate the resilience of our Group with its market leading positions, well-established brands, superior product and service offer and strong financial position.

My view: I previously thought that the NXR valuation was about right. I am now leaning more towards the view that it is undervalued, although I would like to see more progress on debt reduction and I'd also like to see confirmation that the recent acquisition of a South African plumbing materials company ("House of Plumbing") goes without a hitch.

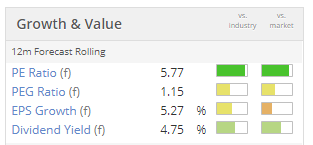

Stockopedia algorithms agree there is some value to be had with this one:

Warpaint London (LON:W7L)

- Share price: 96p (-2%)

- No. of shares: 77 million

- Market cap: £74 million

Results for the 12 months ended 31 December 2018

This is the provider of very cheap cosmetics, trading as W7 (primarily) and "Technic". It also has a division trading "close-out" or excess stock of cosmetics and fragrances.

It had a profit warning back in October, which wrecked the share price:

Today's revenue and adjusted profit numbers are in line with January's trading update. So let's scroll down to theoutlook statement.

Management are "cautiously optimistic".

- "Promising start" to the current financial year

- Heavier sales weighting outside the UK in future

- Sales and EBITDA growth anticipated for 2019.

My view

I still think this looks like a decent outfit, although I'm not sure why I should want to own it instead of Creightons (LON:CRL) (where I do have a long position) or Swallowfield (LON:SWL) (where I do not currently have a position).

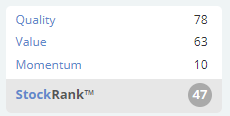

The StockRanks aren't overly excited about it, either (even though Stocko thinks it's on a forward P/E ratio of only 8x).

I'm neutral on this share, currently.

Altitude (LON:ALT)

- Share price: 97p (-6%)

- No. of shares: 69 milion

- Market cap: £67 million

Altitude provides "technology and information services to the promotional products, print and clothing industries". It offers a wide range of services but the ones which people focus on are AIMPro and Channl.

Altitude Group plc (AIM: ALT), the operator of a leading marketplace for personalised products, is pleased to provide a trading update for the year ended 31 December 2018 and to provide an update for the period following the successful equity placing and acquisition of Advertising Industry Mastermind Group, LLC ("AI Mastermind").

This all seems a bit slow, doesn't it?

Last year, Altitude didn't publish preliminary results until early June. This year, it promises to release them on 28 May. Still too slow, in my opinion.

There was some information for 2018 in the circular published in January.

Anyway, the numbers for 2018 will be in line with expectations. Brokers have left their forecasts unchanged.

The company also reports that the integration of AI Mastermind has been "rapid" and "successful"

Shareholders are grumbling on the message boards that not enough information has been released today, and I sympathise.

As for the business? All I know is that it has been tipped to do big things this year and in future periods. If somebody can present the investment thesis to me, I would be glad to learn more.

In other news, the pharmaceutical company Indivior (LON:INDV) saw its shares collapse by 70% after it was indicted on 28 felony counts of fraud. It believes the accusations "are unsupported by the facts and the law". Commiserations to anyone holding that one.

Out of time for today, I'm afraid. Thank you for sharing in my ramblings.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.