Good morning!

To get you started today, here is the link to yesterday's article. I updated it in the evening, having run out of steam during the afternoon. It now covers;

Ab Dynamics (LON:ABDP) - results

GAME Digital (LON:GMD) - results (I added more to this section)

Wey Education (LON:WEY) - unnecessarily deep discount on placing

Walker Greenbank (LON:WGB) - profit warning

On to today's news...

NB. I tend to update the article header to show what companies I intend reporting on. So please refer to this before posting comments below requesting me to cover companies that I'm already intending to report on. Thanks!

Keystone Law

Intention to float - this announcement caught my eye this morning, and might be potentially interesting. Although I got burned on the disaster that was Fairpoint, which went to zero in the end. So I'm very wary of legal services companies.

Key points;

AIM, ticker "KEYS"

Expected to commence trading on 27 Nov 2017

Placing price 160p

Total shares after placing, 31.27m, market cap of £50.0m

Raising £15m (before costs) - of which £5m goes to the selling shareholder, and £9m goes to the company, however this is mostly (£7.4m) to be used to pay off shareholder loans. So in effect, most of the placing monies are to cash out the selling shareholder. Generally I dislike situations where an existing shareholder is using an IPO to exit, because quite often problems subsequently emerge.

Company will be debt-free after the above transactions.

Panmure Gordon is broker & nomad.

The business model is a disruptive legal firm, with its lawyers being self-employed and working from home. Therefore its central costs are low, and fixed. Also, the suggestion is that it can grow profits in future, from operational gearing - due to having fixed costs.

Good 3 year growth of 20%+ p.a.

Results for y/e 31/1/2017 - revenues of £25.6m, EBITDA of £2.1m - grrrr, why on earth do companies give us EBITDA, and not proper profit? This is such an annoying trend.

I would want to see proper numbers before considering investing here, which would be in the admission document. A point to note is that when private companies come to the public market, they often pay their Directors via dividends. So this can flatter profit figures, which need to be adjusted to include realistic salaries for Directors.

My opinion - I'm wary of all new issues, as quite a lot go wrong.

That said, in a bull market, many often go to a premium initially.

I like disruptive businesses, and the business model here seems to have been well thought-through - e.g. lower fixed & office costs, from having self-employed lawyers. There again, it's not exactly rocket science, and plenty of lawyers already work predominantly from home. I wonder also if there might be an issue with HMRC, who are clamping down on self-employment when people are actually really employed in all but name.

I also like that the lawyers don't get paid until Keystone receives payment - another sensible aspect of this business model. So this one might be worth a closer look perhaps?

Norcros (LON:NXR)

Share price: 177.4p (up 2.5% today)

No. shares: 62.3m

Market cap: £110.5m

Norcros, the market leading supplier of innovative branded showers, taps, bathroom accessories, tiles and adhesives, today announces its results for the six months ended 30 September 2017.

The company put out an H1 trading update recently, which I covered here on 12 Oct 2017 ,so I've just re-read that, to refresh my memory. Also a relatively big acquisition and placing was announced, which I covered here on 2 Nov 2017.

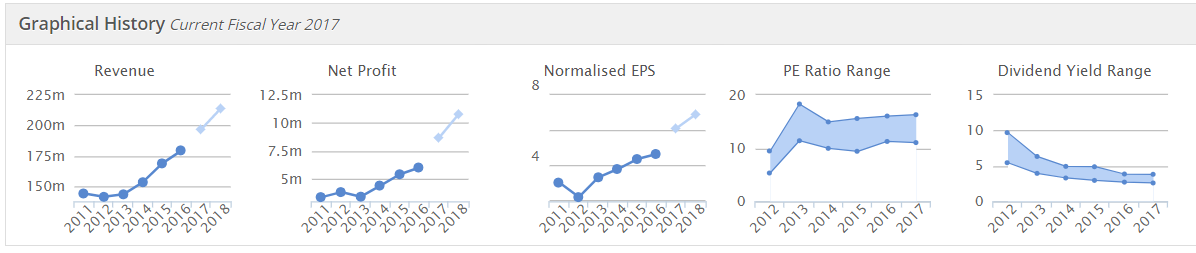

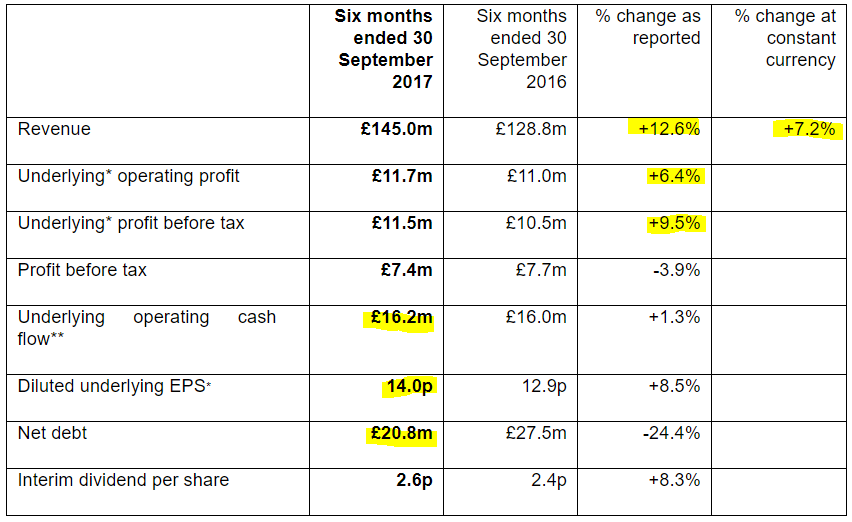

Here's the highlights section;

Note that revenues (and presumably profits too) are being helped by positive currency conversion. Although input costs will also be rising (since products are made in China).

Underlying profits are up, but not as much as revenues.

The business looks highly cash generative.

There's an up-to-date in line trading update;

Given the promising performance in the first half of the year, the Board remains confident that the Group will achieve underlying operating profit in line with its expectations for the year to 31 March 2018."

Full year expectations look to be 28.9p EPS, so that gives a PER of just 6.1 . As I mentioned a few weeks ago, this seems excessively pessimistic, but seems due to investor worry about the enormous pension scheme. Another investor worry seems to be that a fair bit of Norcros's operations are in South Africa - political instability there could be a concern.

Pension scheme - today's announcement says;

The gross deficit relating to our UK defined benefit pension scheme as calculated under IAS 19R has reduced from £62.7m at 31 March 2017 to £52.1m at 30 September 2017, primarily due to a 0.1% increase in the discount rate to 2.70% (31 March 2017: 2.60%) reflecting a slight increase in bond yields. Despite the small improvement, bond yields still remain at historically low levels.

We remain confident that our pension obligations continue to be appropriately funded and well managed, with the Company due to pay £2.5m this year into the scheme in accordance with the agreement made with the Trustee in April 2016. The next actuarial valuation date is 31 March 2018.

In the picture, I see the pension scheme being manageable. Also, as the company grows by acquisition, it is gradually diluting the pension scheme. Interest rates have at least begun to rise a little, so the trend is now possibly in the company's favour? The trouble is that, with such a large scheme(s), it only takes small movements in assumptions & bond yields, to make a big difference to the deficit. That could be good, or bad, only time will tell.

Acquisition - of Merlyn is a big deal, at £60m - roughly half funded by a placing, and the rest from bank debt. The bank facilities are growing to a hefty amount, but I'm very impressed that the bank is offering these facilities on an unsecured basis - indicating the bank has a lot of confidence in Norcros;

If approved, the transaction will be funded by a £31.4m firm placing, placing and open offer of ordinary shares and an amendment to the Group's unsecured revolving credit facility from £70m to £120m.

This is a very different attitude to how the banks were in 2008, and several years afterwards. So investors who were not investing during the financial crisis, should be made aware that credit can be withdrawn very quickly & easily if banks get the jitters in a recession. So I'm not keen on Norcros gearing up too much in the relatively good times. It's probably OK for now though.

Dividends - the interim divi is up from 2.4p H1 LY, to 2.6p H1 TY. There is a pleasing progression in the divis each year. The yield is healthy at about 4.5%. So this looks quite a nice GARP share, which also rewards shareholders with decent divis - quite attractive in a low interest rate environment.

Balance sheet - here are the usual key numbers that I focus on;

NAV: £65.2m

NTAV: £21.3m - which looks rather low for the size of the group, but the main reason is the pension deficit of £52.1m. So if we add that back, then NTAV without the pension deficit would be £73.4m, which looks fine to me.

Current ratio (working capital): 1.69 - which is very healthy.

Note that there is also £29.9m in long term debt.

Overall, I'm happy with the balance sheet, but we need to bear in mind that debt will increase by £30m with the Merlyn acquisition. That's probably at the top end of where I would want to see debt.

My opinion - I very much like the modest valuation here - very low PER, and a decent dividend yield, for a group which is performing reasonably well.

The main downsides are the huge pension fund (but it looks manageable) and the political risk from having a decent chunk of profits originating in South Africa.

As I seem to say every time I report on this company, I'm tempted to buy some! There again, with the UK consumer seemingly drawing in our respective horns, I'm worried that this could perhaps be the wrong time to buy a consumer-facing business. After all, we had a profit warning yesterday from Walker Greenbank (LON:WGB) which reported a sharp downturn in UK demand for its upmarket interior furnishings. Those problems could be limited to the luxury market, but what if it's the start of a more general trend of consumer spending reducing on things like kitchen, bathroom & other household revamps?

On balance, I'm probably not going to buy any, but it's a finely balanced decision. I reserve the right to change my mind at any time, as with everything.

SRT Marine Systems (LON:SRT)

You might be wondering why SRT is in today's article, given that I have already reported on its rather poor interim results here, 2 days ago. This is why...

CEO interview - I haven't really got spare time to seek out CEOs who want to do audio interviews with me, but I keep in touch with the old regulars, like John McArthur of Tracsis (LON:TRCS) and also Simon Tucker of SRT Marine Systems (LON:SRT). Both these CEOs are outstanding in their communications with private investors. So I quite like to chat with them every 6 months, and ask questions which are crowd-sourced from you, dear SCVR readers!

To save time, I now have a dedicated email address for my QualitySmallCaps website. So if you would like me to ask Simon Tucker your question(s), then please email me any time up to this Sunday at midnight, using this email address:

QSCquestions AT gmail DOT com (obviously, please replace the capitalised bits with the usual email syntax. I have just published it like that to avoid spam picking up on the email address.

NB. this is a non-commercial offshoot. I don't charge anything, and there are no adverts, I just like doing occasional interviews, it's interesting & sort-of fun. I'm not in any way endorsing or recommending any companies, of course. The website name implies endorsement, which was a mistake. I should have called it something else, but never mind.

Victoria (LON:VCP)

Acquisition - investors who backed Geoff Wilding's buy & build expansion of an originally small carpet maker, have been laughing all the way to the bank. As indeed has Mr Wilding, who has personally made £hundreds of millions on paper from his success here.

I won't go into all the detail, as it's moved way above my area of focus (typically £10-400m market caps).

What's so interesting about Victoria, is that it seems to have been an impeccable buy & build, which has created enormous shareholder value.

The share price has risen 7.7% this morning to 853p. The placing was at 783p, so people who backed that are already nicely in profit. The acquisition is due to complete today. No doubt brokers will be raising forecasts, since the deal is being part-funded with cheap debt, so is likely to be earnings accretive, even after dilution from the new shares for the equity element of the funding.

My opinion - well done to everyone who holds this share. I've nipped in and out a few times, thinking it looked too good to be true, but am now kicking myself about that. In this case, buy & hold would have been a wonderful decision.

The end game with Victoria has always been to build it up to an international group of carpet & other flooring manufacturers, apply economies of scale, synergies & best practice, then sell the whole group to (most likely American) flooring companies. So far everything seems to be going to plan, in what has been a remarkable success.

Who would have thought that carpet manufacturing could prove such a lucrative area? Apparently it is. I remember well my 1 hour meeting with Mr Wilding last year, and I was tremendously impressed. I'm sure once he's sold Victoria, all eyes will be on what he does next!

Clipper Logistics (LON:CLG)

Share price: 400p (up 1.3% today)

No. shares: 100.3m

Market cap: £401.2m

Clipper (LSE:CLG), a leading provider of value-added logistics solutions and e-fulfilment to the retail sector, announces an update on trading ahead of its interim results for the six months ended 31 October 2017.

Things seem to be going as planned;

Trading for the first half of the year is in line with the Boards' expectations, with growth in revenue, EBIT and net earnings.

The acquisitions of Tesam Distribution and Repairtech during the period have gone well, with both fully integrated and performing in line with our expectations.

Outlook for H2 sounds positive;

The Board remains confident that the combination of continued organic growth in the Group's sectors (particularly e-fulfilment and returns management services), new contract wins and the development of Clicklink will continue to deliver strong performance by the business in the second half.

That sounds to me as if the full year forecasts are probably well underpinned, and who knows the company might even beat them?

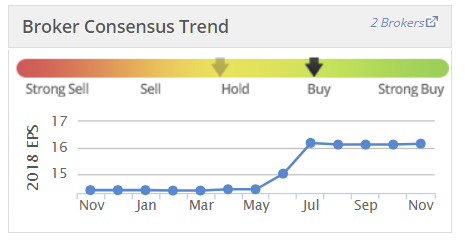

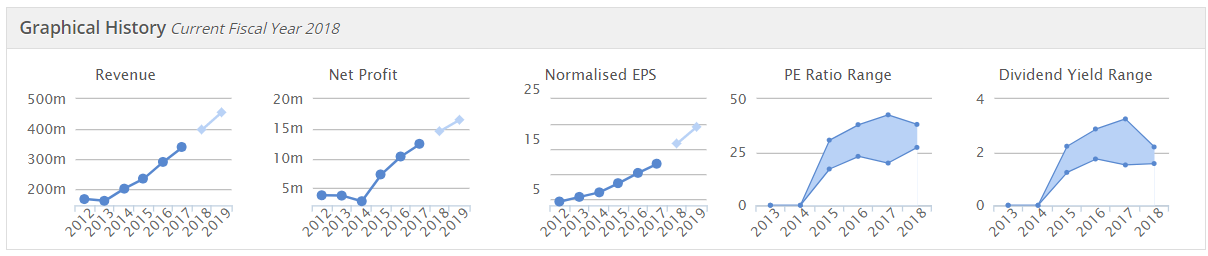

As you can see from the Stockopedia graph below, broker forecast consensus rose during the last 12 months. However, we have to be a bit careful, and remember that with groups that are making acquisitions, this may be acquired growth, as opposed to organic;

Despite having been fully listed since May 2014, I haven't written about this company before. This is a glaring omission, as it's right up my street - being a picks & shovels type company to the eCommerce & retail sectors.

Actually, I only noticed it recently when reading the Admission document for Sosandar (LON:SOS) (in which I hold a long position). Sosandar described their outsourced business model, with Clipper doing their goods intake, storage, and dispatching to customers. Plus I think they also manage customer returns - very important now, as online fashion involves a very high return rate of c.40% on average. Customers tend to deliberately over order, then send back the items they don't like, keeping the ones they do. That creates logistical nightmares for eCommerce companies. Clipper deals with all of that, leaving the client free to focus on what they do best.

Graham wrote a useful piece here on 25 May 2017, on news of Clipper making an acquisition. So that acquisition does seem to have been the catalyst from brokers increasing their estimates above.

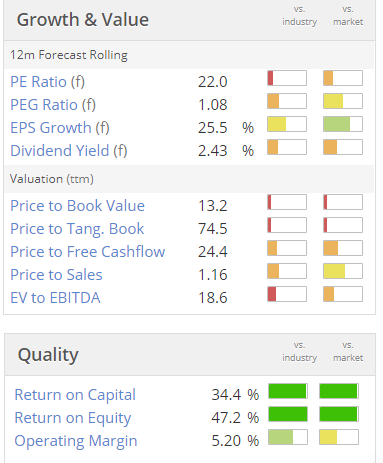

Valuation - the forward PER has come down from 27, when Graham looked at it in May 2017, but is still quite high for what is basically a bunch of warehouses & 3,000 staff, moving stuff about;

As you can see from the high P/NTAV, there's little in the way of asset backing here - the valuation hinges on profitability. The growth track record is excellent though;

Even if some of the growth is coming from acquisitions, that doesn't matter, providing debt is not growing excessively. Note that EPS is growing strongly, which I very much like.

Balance sheet - I've looked at the last balance sheet. It's not great, with negative working capital. However, as we've seen with Wincanton (LON:WIN) , logistics businesses seem to be able to operate fine, even with a terrible balance sheet. The reason seems to be because customers pay up-front to a certain extent, before liabilities fall due. So negative working capital is probably not a problem.

There's no pension deficit here either. Borrowings look fine, relative to profitability.

Overall, there's nothing to be worried about with the balance sheet, in my view.

My opinion - I like this, and am kicking myself for not having spotted it earlier. Being focused on eCommerce, as well as conventional retailers, exposes the company to good growth. It seems to make a reasonable 5% operating profit margin - enough to be a decent business, but not too much to attract lots of competition.

Looking at Clipper's website, it has an impressive client list, and seems to be focused on IT - both in managing its operations, but also integrating with client systems, which is essential these days. I remember trying to manage outsourced warehouses in the old days of doing things manually, and it was chaos - everything was essentially done on trust, so you had no idea what stock the outsourced warehouse held, and they could have been pinching tons of us without us knowing. Things are very different now. It makes complete sense for growing eCommerce companies to outsource everything to Clipper.

At the current valuation, it's a bit too rich for me, but I'll put it on my watchlist as something to possibly buy on a general market sell-off. It could possibly be seen as something similar to Wincanton (LON:WIN) but with better finances, and faster growth. Whether that is worth paying a PER of 22, instead of a PER under 9, is the big question?

Macfarlane (LON:MACF)

Just a very brief comment to flag up this one as potentially interesting. I don't have time to crunch any numbers today, I'm afraid.

This is a packaging company based in Scotland. The company's performance looks very interesting, so worthy of a closer look some time soon;

If forecasts are met (the lighter colour blobs above), then performance would look very impressive. Some growth seems to have come from acquisitions though. I haven't checked the balance sheet for debt.

Today the company says;

The momentum achieved in the first half of 2017 has continued in the second half of the year with improving organic growth and the continuing benefit from acquisitions.

The Board is confident that its full year expectations will be met assuming that the Group benefits from the trading cycle in the final quarter of 2017 through our focus on the e-commerce sector.

The net effect of these factors is that Macfarlane Group's profit before tax for 2017 to date is well above the corresponding period in 2016 with a good contribution from acquisitions and this trend is expected to continue for the remainder of the year.

Debt doesn't look to be a problem, relative to forecast profitability;

Bank borrowings of £14.6m at 30 June 2017 are expected to reduce by the end of the year, reflecting the Group's traditionally strong working capital inflows in the final quarter.

My opinion - this seems to be another company that has slipped through the net here. So I haven't looked at it properly for 3 years. The forward PER looks low, at 10.9, plus it pays a 3% divi yield. I like the update today, and the long-term growth track record looks good.

Add to that, a StockRank of 94, and "Super Stock" classification from the Stockopedia computers, and I really should add this to my list of shares to research in more depth. Can any readers give us a heads up on the company, perhaps?

I have to leave it there for today. Graham will be looking after you tomorrow, as is usual on Fridays.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.