Good morning, it's Paul here today.

Estimated completion time - probably about mid-afternoon. Update at 15:36 - as usual, it's taking longer then expected, so I'll keep going until early evening.

Update at 18:09 - today's report is now finished.

Sosandar (LON:SOS)

(I follow this company closely, as it's by far my largest holding in my SIPP. Obviously just skip this section if it doesn't interest you)

Digital ads - I wasn't able to get any photos of Sosandar's digital ads in selected tube stations in London (see Monday's SCVR). So I contacted the company's PR, to ask for some photos, and more info, see below.

Sosandar's digital ads are shown at selected tube stations in London, during commuter hours, morning & evening, on weekdays. I visited a couple of tube stations at around 3:30 pm, hence why their ads would not have been showing at that time.

Here are a couple of photos sent to me by the PR co at my request;

TV advertisement - There's also a Sosandar TV ad, which is being trialled. Here's the link to that short video.

The background of Sosandar's founders was in fashion magazines. You can see that in the quality of the company's photography & video imagery. It looks like a proper brand.

On to Wednesday morning's trading updates & results statements....

Readers like us to comment here on BooHoo, even though it's now a mid-cap:

Boohoo (LON:BOO)

Share price: 266p (pre-market open)

No. shares: 1160.7m

Market cap: £3,087.5m

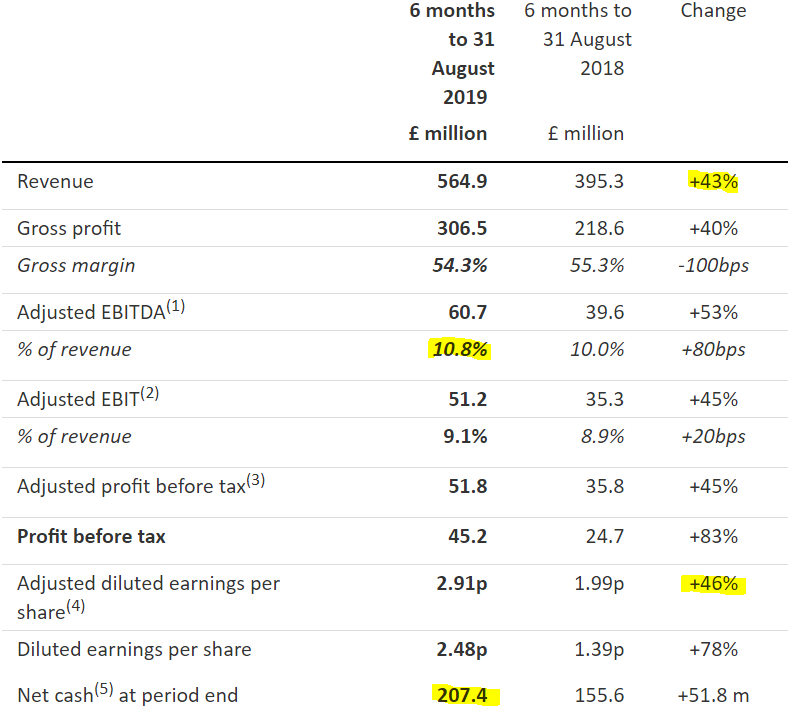

Terrific figures today, from this multi-brand online fashion retailer.

Graham covered its ahead of expectations update here on 5 Sept 2019. As you would expect, with such a recent update, today's figures & outlook are consistent with it.

Here's today's outlook guidance;

Group revenue growth for the year to 29 February 2020 is expected to be 33% to 38%, with adjusted EBITDA margin for the year to remain at around 10%, reflecting anticipated investments across the financial year into the three brands acquired by the group in the first half year.

We reiterate our medium term guidance to deliver revenue growth of at least 25% per annum and adjusted EBITDA margin of around 10%.

Given that H1 revenue growth was 43$, then the 33-38% full year forecast growth looks realistic - and could even be beaten, perhaps?

Valuation - the medium term guidance is very interesting. With ongoing growth of 25%, that almost doubles the size of the business in just 3 years. For that reason, the forward PER of 45 is really not expensive at all, in my view. Such strong growth, globally, easily justifies such a rating, in my view.

My opinion - things are going amazingly well for BooHoo. Every time it looks as if the growth rate is slowing, and the business is reaching maturity, it has a fresh burst of growth! Bolting on new brands (3 more added recently), and applying the BooHoo group's sourcing, logistics & marketing skills, adds another phase of growth after a time lag. For example, Nasty Gal reports 148% revenue growth as part of today's results.

BooHoo really is the stand-out online fashion retailer, and has completely eclipsed Asos in my view (which doesn't generate any free cashflow - indeed Asos is spending far more on capex than it's actually making in profit - a lousy business model).

With multiple brands, and global sales, BOO has plenty of scope for future growth. This is heading towards being a significant global business. As mentioned last time I reported on this company, it's very tempting to buy back in. The valuation looks perfectly reasonable to me, given that it's an absolutely exceptional, and still fast-growing group.

It's starting to look likely that BOO could join the FTSE 100 in the next year or two. Looking at the constituents here on Stockopedia's "Browse Indices" function, the lowest FTSE 100 market cap (Centrica) is £4.1bn, with Kingfisher next at £4.2bn. BOO is currently about £1bn short of that. Therefore next year we could see tracker funds being forced to buy BOO, taking the valuation up further, which is a nice catalyst.

EDIT: thanks to MrContrarian, who points out in the comments below, that BOO would have to transfer to a full listing, to get into the FTSE 100, as AIM companies can't join it.

Mission Marketing (LON:TMMG)

Share price: 82p (down 2.4% today, at 11:55)

No. shares: 85.3m

Market cap: £69.9m

The Mission Group plc ("MISSION", "the Group" or "the Company") is pleased to announce its unaudited interim results for the six months ended 30 June 2019 and sets out its new positioning.

Readers have asked me to look at this. It's a share I've covered a lot before, but not recently.

To bring us up to speed, Graham commented on its in line with expectations H1 trading update here on 15 July 2019.

I commented here on 25 Jan 2019 on its FY 12/2018 positive trading update. If you look at the chart, this is the update which triggered a rise from c.55p to c.80p.

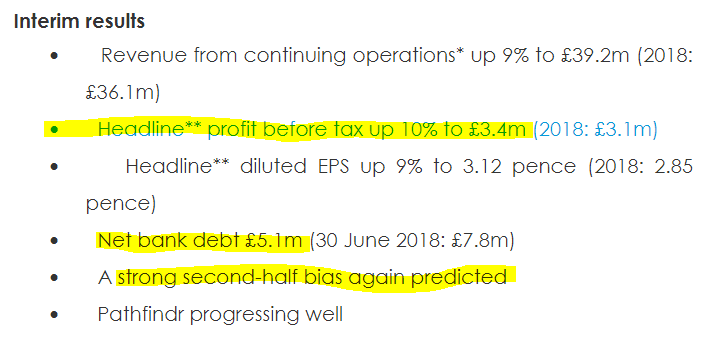

Here is the company's highlights section today;

The 10% reported profit growth is consistent with the last trading update.

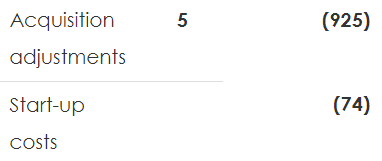

Are the adjustments to profit reasonable? The company says;

Adjustments to headline profits in 2019, at £1.0m, were higher than the prior year (2018: £0.6m) due to an increase in the estimate of future contingent consideration obligations. After these adjustments, reported profit before tax was £2.4m (2018: £2.5m).

Here are the adjustments this year;

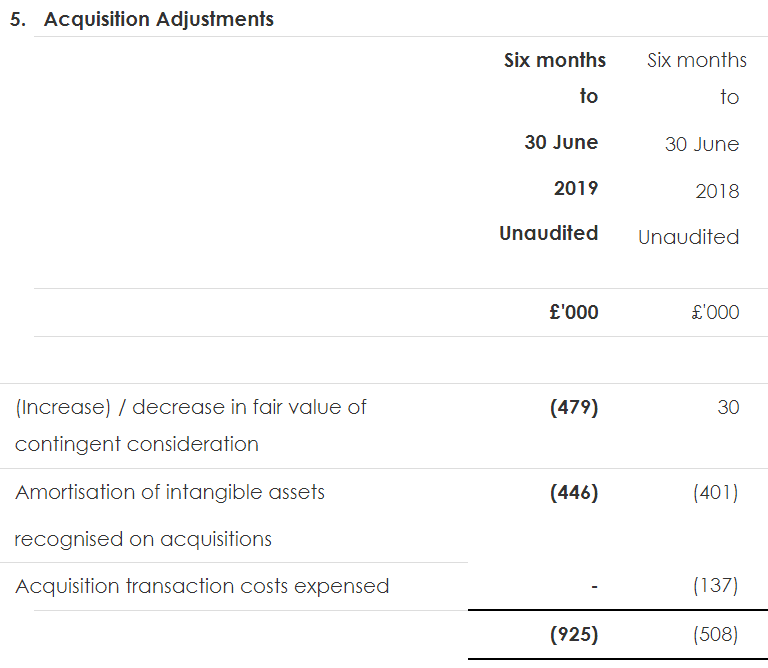

Note 5 gives more detail;

I think those items look fine to strip out, in providing an adjusted profit figure which more accurately reflects the underlying performance of the business.

It's standard practice for analysts to ignore amortisation relating to acquisitions, because it's just a book entry that has no cash effect on how the business is performing, or how it should be valued. It's only of passing historical interest.

Equally, any change in the creditor relating to contingent consideration (for acquisitions) is of interest, but it's not a trading cost. Investors do however need to check the balance sheet, and ensure that an acquisitive group can actually afford to pay out the contingent consideration that it's on the hook for.

Balance sheet - I've had reservations about TMMG's balance sheet in the past. How does it look now?

NAV is £89.9m, this is very overweight with intangibles, of £95.6m which seems to all relate to acquisitions.

NTAV: not good, it's negative, at -£5.7m - all I've done here is write off all intangible assets, so that the balance sheet would be comparable with an otherwise identical group which had grown organically, rather than through acquisition.

Working capital - adequate, but not good, with a current ratio of 1.10 (that's total current assets, divided by total current liabilities).

Acquisition liabilities - this is a significant issue. The company has to pay £2.4m within the next 12 months, and a further £5.9m in the following year. These are highly material figures, which are likely to push up net debt, if these sums cannot be generated in free cashflow (which looks unlikely to me).

Therefore the net debt of £5.1m (obviously I've ignored the irrelevant IFRS 16 lease liabilities) looks set to rise in the next 2 years by potentially quite a lot. Investors need to be fully aware of this point, and not get too comfortable with the current apparently low level of net debt. This matters because it means the company has little scope to pay out decent divis. I can't see the c.2.8% dividend yield going much higher, unless & until the substantial acquisition liabilities are paid off. I'm not sure if they have to be paid in cash, or shares, but the effect is fairly similar on existing shareholders - either less cash for divis, or dilution from the issue of new shares.

Bank loan - also, there is an £8m bank loan (within the £5.1m net debt total) which needs to be paid off or refinanced in 2-3 years. Put that together with the contingent acquisition liabilities, and the group needs to generate a lot of cashflow over the next 3 years, to clear these debts. It might be able to refinance with fresh bank facilities, but if we're going into a recession, then you can't count on that being certain. Remember how credit dried up in 2008.

Cashflow statement - the business looks genuinely cash generative. However, as mentioned above, this cash is being consumed mainly on paying for previous acquisitions, and repaying bank debt, plus a relatively modest amount for dividends.

Therefore, I feel that the divis are not necessarily safe, if the economy takes a downturn.

My opinion - the crucial issue here, is where are we in the economic cycle? The last thing investors should be doing, is buying into marketing companies if we're about to go into a downturn. They tend to be hit very hard, and early, in recessions, as clients cut back on discretionary spend. I don't know whether a recession is coming or not, but there are certainly storm clouds out there. So why take the risk?

Balance sheet risk is quite high too, because of the need to continue repaying the bank loan, and substantial deferred consideration liabilities falling due in the next couple of years.

Conventional marketing companies really don't interest me, as so much is moving online these days. The word "digital" is not mentioned once in today's commentary from the company. I would have expected to hear lots of stuff about what they are doing to expand into that exciting growth area.

Overall then, I can't get excited about this share at all. Sorry if that's not what you wanted to hear!

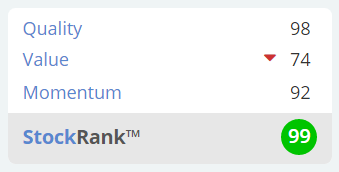

Stockopedia completely disagrees, and rates it a Super Stock, and has a super-high StockRank:

EDIT: please see the excellent reader comments below, which point out this company has one of those awful growth company share schemes.

Afternoon tea at Claridges

Some time ago, a very generous reader bought me a ticket for 2, to have afternoon tea, with a glass of champagne, at Claridges. I've booked it for 5:30pm this Friday, 27 Sept.

Would you like to join me? I've decided to auction the one guest place, to raise money for my favourite charity, ZANE, which I visited earlier this year, and saw at first hand what superb work they do to alleviate the suffering of about 4,000 destitute pensioners with simple food & medication micro grants, plus partnering in other projects such as curing club foot in babies, a women's refuge for victims of political violence in the townships, and other projects of great humanitarian good in Zimbabwe.

It's a remarkable little charity, of terrifically dedicated staff, and makes a relatively small amount of money go a long way. The situation in Zimbabwe is absolutely dire, with another bout of hyper-inflation having further destroyed living standards this year. Electricity is rationed to 10pm to 4am only, and running water doesn't work any more in lots of the country. Many people cannot afford to eat, let alone have any decent quality of life. So money donated to ZANE really does save lives - I met about 200 of the recipients earlier this year, and it's an unforgettable, very moving experience to have a wizened pensioner clasping your hands, and asking you to say thank you to the donors in the UK on their behalf.

If anyone fancies joining me for a very civilised afternoon tea (and then quite possibly a less civilised pub crawl afterwards!) this Friday, then message me through Stockopedia (or via email) with your bid (all the money to go directly to ZANE), within 24 hours please.

I'll then contact the highest bidder, and ask them to donate the agreed amount via ZANE's website & email me the receipt email from ZANE, then we're good to go.

I got this idea from another reader here, who contacted me and asked if I would meet him for lunch, if he donated £100 to ZANE. He wanted to pick my brains on various topics, and discuss financial stuff of interest to him (e.g. several shares, balance sheet concepts, etc). Of course I agreed to do it, and it went brilliantly - so much so that he's asked me to do 4 more such lunches, at £100 a pop for ZANE.

That got me thinking, that maybe someone would like to join me for afternoon tea & have me at your disposal to discuss anything you want, or just have a general natter, this Friday? If nobody's interested, that's fine, as I'll just invite a mate instead. But it would be nice to raise a bit for ZANE. Also, I enjoy meeting other investors & chatting about shares stuff.

So, anyone who is interested, please message me with the donation you're prepared to make to ZANE. The highest, hopefully generous, bid wins!

What else is on the agenda? A couple of brief comments;

Universe (LON:UNG)

5p per share, about £12.5m market cap, so too small to interest me unless there's something really exciting happening.

Interim figures today look OK, but not madly exciting. Balance sheet looks adequate, but not strong.

Why is this company listed? It looks too small, and not really generating much in the way of organic growth.

Hornby (LON:HRN)

A reassuring AGM trading update - H1 sales & margins are said to be up on last year, and in line with internal budgets. Warns about possible Brexit disruption, as heavily dependent on Xmas trading, which could be disrupted, maybe, if the ports experience disruption. Although why that would be the case, when authorities on both sides have already & repeatedly said that the flow of traffic will be paramount, I don't quite understand.

With such a poor track record, I find it too much of a stretch to see a worthwhile turnaround here, hence this share doesn't interest me.

Nice quip re Brexit from Hornby today;

We regret not producing a Brexit themed model. Our new grasp of social media has shown us that people are passionate about sharing their views on the topic. If the situation persists, we have plans for a locomotive that reliably gets stuck between stations. Please subscribe to our exciting new YouTube channel, "Signal Box" for updates: YouTube - Hornby Signal Box

This got me thinking about what other companies could do to innovate on the theme of Brexit? Looking at my watchlist for ideas;

Revolution Bars could do "The Brexit" cocktail - guaranteed to make you see red, rant incoherently about things you don't really understand, and fall out with most of your friends! Although their existing products arguably achieve that already!

Card Factory could start a range of greetings cards, to sympathise for Brexit Derangement Syndrome, as the UK has a collective mental breakdown.

Dart Group - their jet2holidays division could do mystery Brexit tours, ultimate destination unknown, but promising to fly you round in circles for 3 years+

LoopUp could launch a new Brexit service, the Endless LoopUp

That's probably enough of that for now!

Netcall (LON:NET)

This is another small cap that I struggle to understand. It spent a lovely cash pile on an acquisition which looks a questionable decision at this stage.

The share price has more than halved in the last year, from c.60p to only 25p today.

I've had a quick look through today's final accounts for FY 06/2019, and am left unimpressed. Adjusted EBITDA fell considerably, from £5.4m last time, to £3.4m this time.

The apparent near-doubling in operating profit doesn't stand up to scrutiny, as it benefits from one-off impairment costs in the previous year (providing a soft comparative for this year), and a favourable £865k benefit from favourable movement in contingent consideration liability this year but not last year, again flattering this year's figure.

The balance sheet is now weak, with NTAV negative, at £-7.3m

Hence the £36.5m market cap, at 25p per share, doesn't look a bargain to me. But there again, I don't really understand the business, nor its prospects. A brief review just confirms to me that it's probably not worth the time to dig any deeper.

Carclo (LON:CAR)

Some signs of life here;

The Technical Plastics ("CTP") and Aerospace Divisions have both performed ahead of expectations for the first five months of the current financial year, with CTP operating profits well ahead of the same period last year.

However, the deal-breaker for me is that the group has far too much debt still, and we don't know how much the problem Wipac division is going to be sold for (if it can be sold at all?)

Therefore, it's impossible to value this share. There's a very real risk of a 100% loss here for shareholders, hence I think risk:reward looks awful, and I wouldn't risk any money on it.

Alarmingly, the Group FD Designate, who only joined on 3 Sept 2019, has decided to leave on 27 Sept. That tells me everything I need to know. Hence this share seems uninvestable to me.

Scientific Digital Imaging (LON:SDI)

A reassuring update from this group;

The Group has made a good start to the new financial year. Despite the potential for economic headwinds, the Board is comfortable with current trading and in delivering financials in line with market expectations for the year. The Group continues to perform well and we look forward to updating the market further with our half year results in December 2019.

Forward PER of 13.9 looks good value.

Worthy of a closer look, in my opinion.

Card Factory (LON:CARD)

Share price: 180p

No. shares: 341.5m

Market cap: £614.7m

These figures were published yesterday, when Graham was on duty, but he ran out of time, and wasn't able to cover it. As retail is my sector specialism, I'll circle back to it. This share has been on my favourites list (although I don't personally hold any) as a sustainable high dividend yielding share, for some time, see my previous positive comments here about the company.

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces its interim results for the six months ended 31 July 2019.

Graham reported on the company's H1 trading update here on 13 Aug 2019. Ah, I've just realised that I wrote that section for inclusion in Graham's article - I thought it sounded familiar!

Interim figures - I can't see any surprises here;

Revenue up 5.5% to £195.6m - most of the growth is coming from new store openings

Underlying profit before tax in H1 is down 7.9% to £22.0m - note the high profit margin of 11.2% of revenues, way above most retailers these days.

New retail partnerships - this strikes me as very pleasing (although no figures are given) - and this could trigger a re-rating, from CARD being seen as purely a retailer, to something altogether bigger, and more international maybe? That could be what has triggered a nice rise in share price yesterday and today, possibly? I'm guessing there.

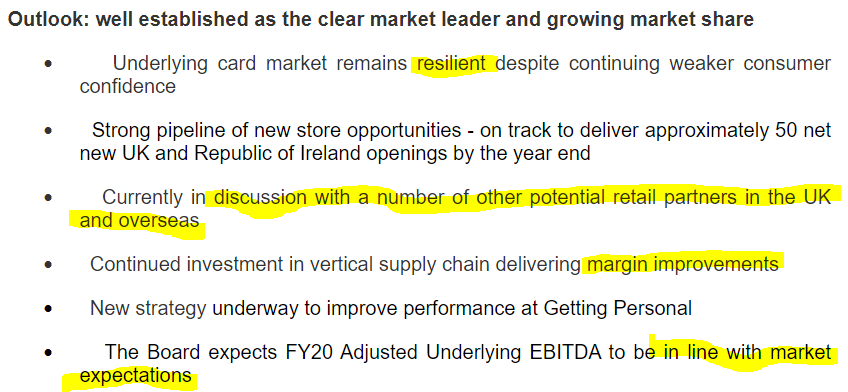

Outlook comments also sound pretty good, for a business that some investors seem to have almost written off as in terminal decline;

Dividends - I remain of the view (indeed probably strengthened after this RNS) that the high dividend yield looks safe. Interim of 2.9p is maintained, plus a 5.0p special divi declared.

There's more detail on dividend policy in the RNS.

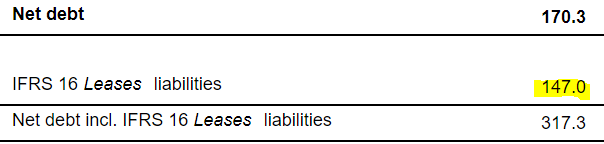

Net debt - IFRS 16 has made a nonsense of the figures. I think the share price rise this week has demonstrated that investors are clearly ignoring IFRS 16 adjustments for the absurdity that they are. For example, here is the revised net debt for CARD;

Tell me why any rational investor would treat future rental payments, on profitable shops, as a liability to be recognised now on the balance sheet? The leases are an asset, not a liability, if a company is trading profitably from that site. It's just ridiculous.

Also, if we're including contractual rent payments, then why not also include the business rates that will also be payable? Whilst we're at it, why not include all the utilities too? How about putting all future staff wages costs onto the balance sheet as a future liability too?

IFRS 16 just doesn't make any sense at all, and it should be scrapped. The old system of making a provision for onerous leases, when a company is trading at a loss from a particular site, was perfect. After all, it's only in that situation where the lease on a loss-making site is a commercial liability.

For my purposes, IFRS 16 doesn't exist. Just like the Supreme Court's treatment of the Government's proroguing of Parliament, I am simply going to treat IFRS 16 as if it hadn't happened, and reverse out all the entries relating to it, in my analysis.

Clearly the people who dream up accounting standards, need to open up their communication channels, and consult more widely with those of us who actually use accounts, and ask our opinions before implementing utterly ludicrous rules like IFRS 16. That said, I cannot say that accounting standards generally are bad, just this one instance where things have clearly gone badly wrong.

My opinion - is positive. This looks an excellent share for income seekers, e.g. SIPPs which are in drawdown. I think the divi yield looks long-term sustainable. The growth from new partnerships seems most encouraging, and may help improve perception of the company amongst investors. Therefore, as well as a cracking dividend yield, there's a good chance of a re-rating to give some capital growth as well, maybe.

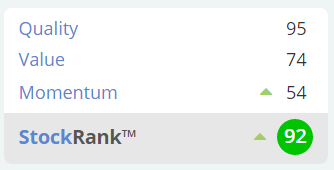

A big thumbs up from Stockopedia too;

All done for today. Many thanks for dropping by, and for interesting reader comments.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.